No matter how you look at it, healthcare, and specifically health insurance, is a headache. The US healthcare system, for all of its advancements, is painfully expensive and a complicated mess.

This is an update to our previous healthcare chapter to integrate in the added challenges and benefits of the Affordable Care Act (ACA – aka ObamaCare’). This article is written with the intention to help others navigate the current healthcare system as a nomad, irregardless of anyone’s political opinion.

We love comments, and welcome yours – but please do keep them non-political.

The challenge is magnified for the self-employed. And then magnified to another level for people without a fixed home. Which makes healthcare an extra challenge for us working aged, often self employed, nomads.

This article is geared specifically towards US based working-aged nomads who are not eligible for Medicare benefits.

For the latest on all of this, be sure to check out RVer Insurance, they put out an annual guide to the options:

November 2014: Video chat overview with myself and Nina of WheelingIt.US on healthcare on the road (still relevant):

The Healthcare Problem for Nomads

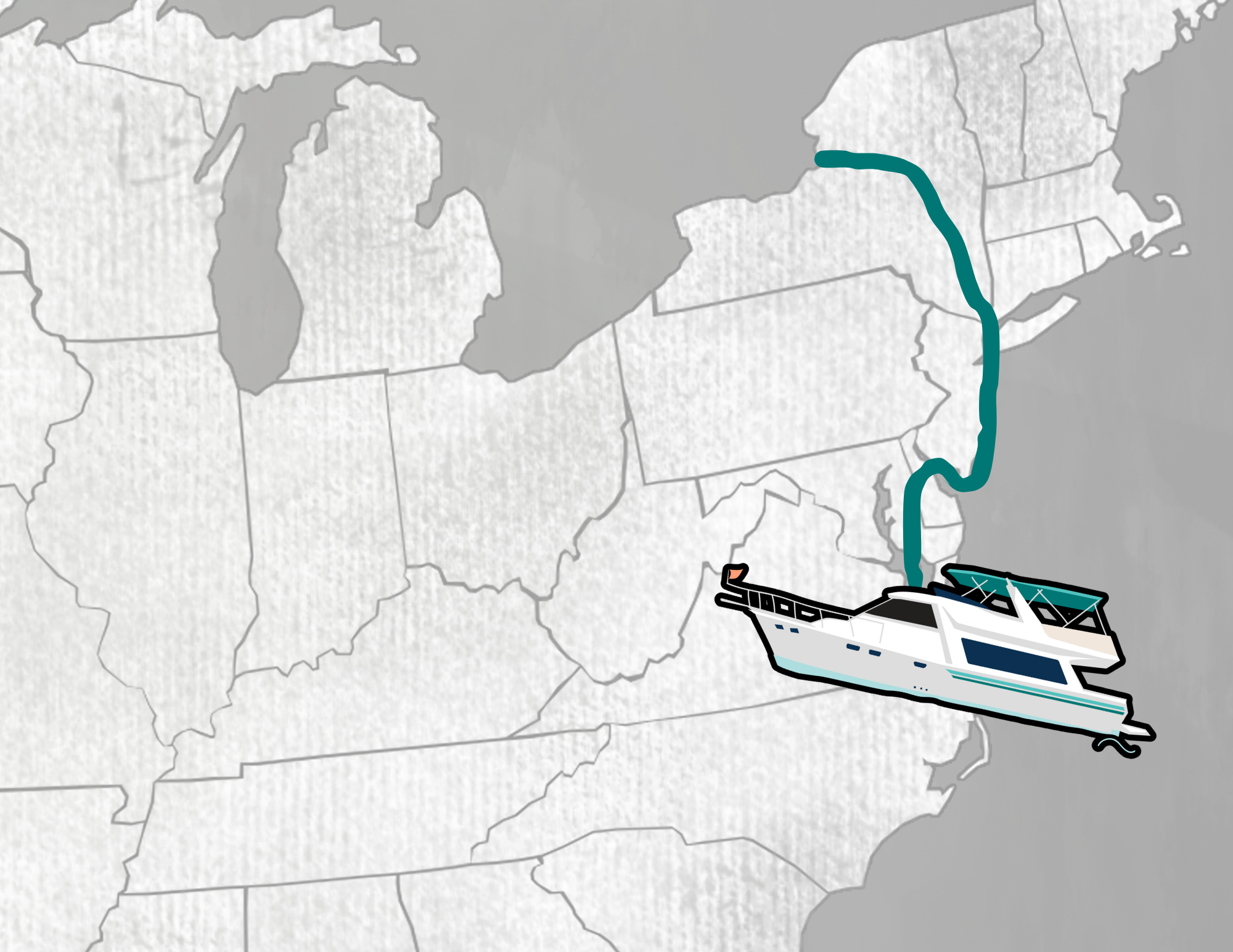

The US health insurance industry has grown from a foundation of locally negotiated contracts between insurers and providers, and there are very few provider networks that are extensive enough to be considered nationwide.

Many healthcare plans don’t even cross county or state lines due to different accreditation processes and regulations that vary from state to state.

This localization presents a unique problem for those who are mobile.

Nomads have always had to shop carefully for plans that have access to a provider network that are in locations they are most likely to travel, and the ACA has added some extra complexities to this by tightening down provider networks to reduce costs. Nomads should pay specific attention to what a plan’s deductible for ‘out of network’ services will be, as they stand a higher likelyhood of needing to access care while away from a provider within their network.

Some insurance companies may offer a fairly nationwide network, but still only cover emergency services when outside your state of domicile.

Some nomads specifically will shop for the lowest premiumed health plan they can find, counting on (hopefully never) using the higher out of network deductible. After all, when it comes to attempting to isolate yourself from a $100k+ medical expense, the difference between an in-network $6,000 deductible and an out-of-network $19,000 deductible can still be a shield from a bankrupting medical encounter.

Aside from provider networks, the nomad must also shop for health insurance providers who will actually insure them. Some companies in some states actually require that the insured live at their “home” address for at least 6 months out of the year.

Another challenge nomads face is finding consistent health care while on the road. Unless they are frequently returning to a home base where they can keep their own cadre of providers for routine check-ups, more than likely they will be accessing healthcare with providers as varied as their locations.

The Healthcare Problem for the Self-employed

Many nomads are self-employed or taking a string of contracting & temp positions. Thus they are ineligible for the sorts of large group plans that are often accessible with more traditional jobs. Our current healthcare system evolved around insurance being an employer provided benefit, thus most of the current best options remain with larger group plans.

If you’ve been insured most of your life via your or a family member’s employment — you may not have ever needed to deal with the hassle of seeking out private insurance on your own. Thankfully this is one area that the ACA brings some relief, by making individual and small business plans more accessible with less risks.

If you’ve been insured most of your life via your or a family member’s employment — you may not have ever needed to deal with the hassle of seeking out private insurance on your own. Thankfully this is one area that the ACA brings some relief, by making individual and small business plans more accessible with less risks.

For instance, now all ACA compatible plans must cover pre-existing conditions and some preventative services, which will open up a lot more options for those dealing with health issues to leave big corporate America and pursue independent income sources without worry of being able to obtain healthcare.

Larger corporate plans do still have a lot more clout that significantly reduces costs, and usually have lower deductibles, co-pays and attractive benefits like prescription drugs, vision and dental.

A member of a large group is less likely than an individual to have the insurer deny benefits when you need them most.

If you’re considering going nomadic and are able to take your existing ”big company” career with you — look closely at your group plan. Unless you work for a company that supports workers in many locations, most of the plan options are likely to be regionally based. This is especially true with the more affordable group plans, such as HMOs – which typically only cover emergency services when outside of your network.

If you have a PPO or indemnity option, you may be better off choosing it to at least have some coverage for out-of-network providers. Even still, you may find that your company simply doesn’t offer insurance options suitable for a traveling lifestyle — and you too will be out shopping for insurance.

Healthcare options for US based nomads

So, you’re a nomad (or want to be soon) – you’re likely going to be facing both the nomad and the self-employed insurance problem. What are your options?

- For domestic nomads without an option of a group plan, seeking individual plans is a popular choice. The section below will go into more details.

- If you own a business, you may have options for starting your own small business group plan – shop around within your state to see if you can find a plan that gives you nationwide access more affordably than individual plan options.

- You may quality for or already belong to an organization that offers access to a group health plan, or a medical sharing plan, that could be worth checking out.

- Short term medical plans may be an option, but will come with pre-existing condition clauses.

- Some organizations, particularly faith based ones, offer health sharing programs that aren’t exactly insurance – but can be an affordable way to go (at least in terms of premiums). However many require you pay out of pocket, and then request reimbursement – which is not guaranteed.

- Some domestic nomads working for a company have been able to keep their group plans as they travel.

- There are travel insurance policies that cover you while away from ‘home’ that might be worthwhile checking out as a supplement to plans that don’t cover you nationwide. Check out the policies offered by WorldNomads.

- Many are left feeling like they have little option than to go without healthcare insurance and planning to self pay for all their healthcare. Perhaps even traveling to other countries for access to lower cost care. This can be a big gamble as healthcare costs can quickly get you into substantial debt in the event of an unexpected major illness or accident. But there are many clinics, low cost options, ability to negotiate cash payments and grant options out there.

Individual Insurance Plans

Many of the US based nomads we’ve spoken to have gone this path, so we’ll address individual plans in further detail.

If you’re used to benefit-abundant group health plans, particularly HMOs where you have nice set co-pays for everything you might need, you’re in for a shock when you start shopping for individual plans.

Most individual plans will have a substantial annual deductible ($1000 – $9000 per person) that you pay out of pocket before any substantial benefits beyond basic preventative care kick in, making these plans the equivalent of older-style ‘catastrophic’ or ‘major medical’ plans designed to protect you from the big stuff.

Under the ACA, all new plans must now provide some basic included preventative services before your deductible is met – so things have improved here. The included services are rather limited however, such as only covering basic cholesterol screenings but not kidney and liver functions. And if you have an abnormal reading on a preventative test, future testing is re-classified as diagnostic for treatments – thus no longer eligible as included pre-deductible.

So do be prepared that you’ll be paying out-of-pocket for a lot of your routine care and should have funds accessible for your deductible.

Essentially, unless you are unfortunate enough to have a health situation that puts you over your deductible – you will probably be paying your premiums AND most of your routine healthcare costs. And that’s just not going to seem fair.

On the plus side, the premiums for this sort of insurance are generally much less than fancy plans that include lots of benefits – so if you’re not actually using a lot of health care, you could come out ahead. If you’ve been covered by an employer, you may not be used to seeing your full health insurance bill – so paying for insurance yourself is going to be a big ouch no matter how you slice it.

Since private insurance generally has high deductibles anyways, you might select policies that are eligible for a HSA (health savings account). This is a tax advantaged savings account you can contribute towards for spending on most medically related expenses, even if not covered by your health insurance plan (such as dental check-ups, flu shots, laser eye surgery, etc.).

It’s similar to an IRA in some ways. It’s not like a flex spending account associated with employer provided insurance, in which you lose any unspent money at the end of the year. HSA’s roll over year after year, allowing your balance to grow. And all contributions to your HSA are ‘taken above the line’ (before deductions) on your taxes, effectively allowing you to write-off your health care costs without itemizing or having to spend a certain percentage of your net income on healthcare.

Not all insurance plans are HSA-eligble – they have to be higher deductible and not offer co-pays – so if that’s something you’re interested in, make sure they are designated as such.

Even if your insurance deductible is so high that your plan rarely pays for anything – the often over-looked benefit of having a health insurance plan is that it can increase your access to the healthcare system as a whole.

While an emergency room can’t deny you life saving care to stabilize you, providers CAN make obtaining non-critical care difficult if you don’t have an easily demonstrated way to pay.

Having an insurance card can be a golden ticket past all this hassle when you need it. And most plans have negotiated rates that you have automatic access to, rates that you wouldn’t otherwise if you were paying full rack rates.

Of course, if you have cash in hand – some providers are willing to negotiate their services to a point that may even be cheaper than the insurance negotiated rates.

You may need to do some extensive calling around to find a provider who will be able to give you a firm quote for a cash transaction however, so many are set up for dealing primarily with insurance billing.

So where do you find Individual plans?

Some of the private insurers many nomads we’ve talked to have selected include: Assurant, Humana, Aetna, Golden Rule, Coventry and Blue Cross Blue Shield. (This is not an endorsement for any of them – do your own due diligence and shop for your needs, and make sure the plan you select will cover you.).

You can use internet brokers like ehealthinsurance.com to quickly shop multiple insurers at once to get an online quote and start playing around with numbers, or you can go to each company’s website and get online quotes individually.

Formerly RVerHealthInsurance.com – now partnered with the Escapee’s & Xscapers RV Clubs, the RVerInsurance.com Exchange is a central resource for RVer specific insurance information. They have agents knowledgable and ready to help us RVers, and track the industry.

Formerly RVerHealthInsurance.com – now partnered with the Escapee’s & Xscapers RV Clubs, the RVerInsurance.com Exchange is a central resource for RVer specific insurance information. They have agents knowledgable and ready to help us RVers, and track the industry.

Many insurance agents can also quote you rates and get you setup if you prefer to not do it yourself. But make sure they understand the specific needs of your mobile lifestyle.

You’ll find the rates will vary given the zip code you’re rated at, so if you’re still settling on a domicile and legal address – comparing health care costs can be a deciding factor.

And some insurance companies have access to multiple provider networks which can change the rates as well.

And for us nomads, there are some key features that can make a plan more ‘nomad-friendly’ than others:

- A healthcare provider network with services in the most likely places you’ll travel – do a search on the network’s website to see if there are providers in areas you’ll be, and if they’re included outside of your state of domicile.

- A plan that does not have limitations on what they’ll cover when you’re away from your state of domicile – some may only cover stabilization after an emergency, or have limits on how much of your medical care can be acquired out of state.

- An insurer who does not have a requirement that you live in your state of domicile for a set amount of time each year.

- Telephone and/or internet access to doctors for basic diagnostics & prescription writing, like respiratory infections, can be hugely beneficial and reduce dependence on urgent care clinics.

- A patient advocacy or concierge service for assisting you in finding healthcare options when you need them.

When shopping around, you may need to look further than the basic benefits listed to find out if these things are included or not.

And no, the headache you’ll get from shopping for insurance will not be a covered incident under your new plan.

Handling Healthcare on the Road

One of the hassles of nomadic travel is keeping consistency in your health providers.

Unless you return often to certain locations frequently, more than likely you won’t always be seeing the same providers. And getting into a provider in a new location when you need it may be a challenge.

So many health providers require you to be ‘established’ before they’ll see you as a patient, and good doctors sometimes have multi-month waiting lists to be seen as a new patient.

But what if you’re just in town for a week, and have a major respiratory infection? You really don’t have time to go through getting “established” just to get someone to look up your nose, listen to your lungs and prescribe some antibiotics.

Some potential solutions to this might include:

- Using a telephone/internet accessible doctor consultation that can prescribe medications for the basics. Your policy may include Telehealth options, your primary care physician may offer it or r some organizations offer services as an add-on option (RVerInsurance.com offers varying packages.)

- Utilizing urgent care clinics (which may be the same or cheaper than paying an office visit to a regular doctor).

- Self treating by stocking basic medications onboard (ie. you can get most things without a prescription over the border).

Self care also becomes a great asset to a nomad. Staying fit, eating the right diet for your body and getting in tune with your body are all easy and resourceful ways to monitor your own health while in motion.

You can even order up your own lab testing across the country online (such as at http://www.healthlabs.com or http://www.directlabs.com) or attend healthfairs offering testing, without needing a doctor’s order. Learning how to read your lab results put you in better control of your health, and can alert you to lifestyle changes you might need to make or when its time to seek out the care of a professional.

Check out our RVing friend’s extensive series about self care on the road for more inspiring ideas: http://wheelingit.wordpress.com/category/health-care-2/ (Doesn’t Nina just rock?)

As a traveler who might need medical care in a variety of locations, you also need to take responsibility for your medical records and having them accessible to new providers. Now that electronic medical records (EMR) are becoming more standard, it makes it a lot easier for you to be able to log into your past provider’s website and pull up your records.

If you do become established with a primary care physician, make sure they offer such a service. You may also want to get copies of past test results and procedures, and carry around at least electronic copies, and have an off-site backup located somewhere with them.

Sadly, our cat has better centralized, nationwide, medical records with her Banfield vet plan (located in most Petsmarts) than us humans!

For those with ongoing health issues that need to be monitored, you may need to work with a healthcare provider who will order tests with a nationwide network of labs and then read your results.

And some doctors are better than others about communicating with their patients remotely – if you find one, keep them.

And always leave open the possibility that if you need extended treatments or major procedures, you may just have to find yourself a nice city to plop down in for a while to attend to matters.

One of the benefits of being a nomad is that you’re not tied to location to find the best medical treatment for you – go to where the specialists are!

Health Conditions

A common reason that a lot folks don’t travel as much as they might like is that they have a current health condition they’re treating, and need to remain nearby trusted medical care sources.

For serious illnesses, this is an unfortunate legitimate reason to stay in one place.

However, we have met a good number of folks dealing with some chronic conditions, who despite the extra logistics – still get out there and travel.

Perhaps they plan to be near their trusted providers when major things need to be checked or treated, but the rest of the time they’re out exploring. They may have to jump through some extra hoops to set up dialysis across the country, for example – but they’re reminded of the preciousness of life, and don’t want to waste a single moment either.

And it’s also a good reminder that no matter what you’re dealing with today healthwise, things can make a turn for the worst at any time.

Why delay living our dreams? How many times have we heard the story of someone preparing their life to hit the road, then wham – they’re facing seemingly unending treatments or a terminal diagnosis?

If you’re in good health today – there may never be a better time to cure your wanderlust than now.

Staying Fit on the Road

Another concern along these lines is how do you stay in good health on the road?

One of the benefits of being stationary is establishing some routines, including fitness & diet. Stopping off at the gym after work is a lot easier when you have a gym on the way home – which won’t always be the case when you’re on the roam.

And when you’re traveling, it’s so tempting to indulge in trying all the yummy new local cuisines and constantly living it up with friends you visit. For the first several months of your travels, it may also feel more like an extended vacation than daily life, and thus makes it even harder.

If you’re anything like us, you’ll probably need to put a little attention towards making effort to keep fitness and proper diet a priority in your life.

There are some nationwide gym networks that you can join, if that’s your thing. Some dry-camping nomads even enjoy them just to have regular access to long hot showers.

Carrying fitness gear with you can be a challenge when living in a small mobile space. We’ve had our share of trouble trying to carry bikes with us in the past, so we mostly rely on walking, jogging, kayaking, hiking and just being active.

We like to seek out campgrounds with easy access to trails, as that greatly amplifies our likelyhood to get out and get our bodies in motion.

Others have reached out to locally based fitness groups to both keep active and make new local friends – such as run clubs, hashing, acro-yoga, hooping, hiking, training, kayaking, etc.

Whatever your modality of being active is, plan ahead for needing to keep it a priority. While being nomadic involves a lot of motion, it can be super easy to slip into being quite sedentary behind the wheel.

Our current healthcare solution

One of the core reasons we moved our domicile to Florida in early 2013 was because of the increased healthcare insurance options over our previous domicile of South Dakota.

For 2020, we renewed with Florida Blue on a PPO plan, which is one of the few plans that includes in-network coverage across the country. In previous years we purchased through the exchange, however we haven’t qualified for subsidies in several years due to our income levels – so we opted to purchase directly from Florida Blue. Our Silver plan with them gives us a better policy for slightly lower premiums than the Bronze plan we had on the exchange. Our premiums are $840/month for the two of us – we have a fairly high deductible, but preventative is free, and we have co-pays for some services.

New in 2020, many Florida Blue plans include Teledoc with just a $10 per use co-pay- a Telehealth service we’ve used for years and love. Before Florida Blue offered it, we used to subscribe through RVerInsurance separately.

<— Read Chapter 11: Tackling the Overwhelm of PreparingRead Chapter 13: Lack of Continuity while Traveling Full Time —>

What happened to the eBook version of this series?

We used to offer an eBook version of this content on a ‘Pay as you Wish’ basis. That book got so out of date and we have no time to keep it updated – so we took it down.

We do our best to upkeep the segments in this blog series, but realistically can’t see republishing the book edition.

In November 2018, RV Love released their brand new (professionally published) book – Living the RV Life. It goes over a lot of similar content to this series (and more) on RVing. We highly recommend picking up a copy!

You’re of course welcome to browse the No Excuses: Go Nomadic series online for more of our tips & tricks on the logistics of nomadic travel.

If you do appreciate this series or the content on our blog, we always LOVE hearing your appreciation – leave a comment, leave a tip (link at bottom of every page) and/or share this post. Thank you!

Hello! It’s now April 2020! We are considering taking on this lifestyle in the spring of 2021 and wondering if you could give an update on the ACA insurance rules as they stand now for getting medical care while being a Nomad. My husband has Medicare but I am on Medicaid and I won’t be eligible for Medicare for 4 more years. Thanks so very much!!!

Nothing has really changed – other than there no longer being a penalty. Be sure to check the RVerInsurance.com link – they keep up with this stuff.

My husband retired July 2nd, 2018 with a very nice pension and we became full time RVers with our Domicile in S Dakota. We chose Dakota Post for our address with a PMB there. (Personal Mail Box). We picked up our new Coach and drove to S. Dakota to meet with our insurance rep. in Madison, SD. He had known we were coming because we had flown in to see him on May 22nd. The first thing he said to my husband, who just turned 62, was that the federal law had just changed on July 1st and because we had no physical address, he was not allowed to get health insurance. He contacted agents all over to find something and the answer was NO. Unfortunately this put him in a very bad situation as he had declined Cobra thru his job he just retired from because we were told in May that he would have this new insurance in July. Apparently Congress passed this new law because they believe anyone who doesn’t have a physical address is probably a terrorist. So he doesn’t have insurance because he can’t get it and yesterday when we had our taxes done, he was fined $1175.00 for no health ins.

This is fraudulent on the part of the govt because they made the rules to prevent him from getting it. Any ideas on how to file a complaint as to get our money back??

HELP HELP. HELP.

We’ve heard of no such law that says you have to have a physical address to get health insurance. If that was true, it’d be all over the RVing community, and there’s no mention of it in RVerInsurance.com’s resources.. or the Escapees. Sources we trust. I think you were given bad advice.

My wife and I are looking at hitting the road. I have a good fixed pension and am fortunate enough to be able to “adjust” legally, our income to suit our current ACA health coverage so that we qualify for good subsidies.We would be able to name our domicile in Florida. Are there still several options there? I ask because we live in Iowa now and there is only 1 option.

Our FL ACA plan renewed this year. Didn’t look much further into what other options remain in Fl – but the RVerInsurance.com link should have all the info.

State residency requirements are NOT the same as ACA residency requirements.

In January 2016, the Department of Health & Human Services (the guys who run the ACA) published guidelines for people who move around a lot — like RVers.

These guidelines attempt to clarify the SEP (Special Enrollment Period) provision of the ACA. Essentially SEP allows you to enroll in an ACA plan at any time as long as you have a “special’ need (like moving).

For example, let’s say you domicile in Wisconsin, but spend 5 months in Florida. For those 5 months you should be able to sign up for a FL ACA plan. The ACA is based on where you actually reside, not necessarily your domicile.

For more details, see https://rvseniormoments.com/2016/11/15/state-residency-and-aca-obamacare-health-plans/

They may not be exactly the same, but for most of us it applies the same. I think you’ve over simplified the issue in your blog post, and the document you link to very clearly states:

“Individuals visiting an Exchange service area for a transitory purpose, for example, to attend to a business matter, obtain medical care, or for personal pleasure, do not have a present intent to reside, and do not meet the residency requirement for Marketplace coverage for the Marketplace service area they are visiting.”

If you’re very intentionally a seasonal RVer who splits their time between two locations a year – perhaps you can apply the residency rules.

But many of us identifying as nomads (the audience intended for our article) are very intentionally transitory visitors with an established intent to domicile in our county of choice. Trying to establish your residency in another location for purposes of health insurance (especially in a tax aggressive state) could very well put your domicile claim in jeopardy.

Thank you SO much for this informative article! I’ve enjoyed your YouTube channel and website along with all the valuable insight you provide in the Make Money & RV Facebook group!

I assume that you use the zip code for the mail service/domicile to determine plans and rates for your 2016 solution – correct? We currently live in FL but will be selling the house and full-timing for about a year – so I guess we should make sure the plan that makes the most sense now is similarly priced and available for Green Cove Springs (we’re considering St. Brendan’s Isle as family may not be an option). We have to make a change mid-year as my husband becomes eligible for Medicare and it looks like his retiree coverage supplement is not the best choice so I’ll lose my coverage and need to find new insurance. Thankfully the Medicare supplements are easier to figure out (not much but a bit).

Appreciate all your assistance – Charlie has been spending quality time with your technology sections trying to sort out data plans and antennas – so helpful to him.

Yes, we use our SBI zip code for everything – as it’s our legal address. Other mail forwarding services in Florida may offer better insurance rates, so be sure to check them out before signing up with any of them. For instance, we know we could be saving a bit of money every month on both auto and health insurance if we ‘moved’ to the new Escapee’s address option in Bushnell. But at present time, it’s not worth our logistical effort to go through the process.

So, just curious, there were a lot of changes in the market place again this year ……. what have you chosen to do for 2016? We have a plan that is a high deductible PPO that is grandfathered back to 2007 but doesn’t include pharmacy or the now automatically covered essentials. As is, it is several thousand dollars cheaper per year (if maxed out) than what we’re seeing to replace it with. That several thousand dollars covers quite a few prescriptions! The downside is we are getting ready to go full time and I don’t know that they will let us continue with the plan when we do, thus all the investigating and teeth grinding.

Check the last section of the article (Our Current Healthcare Solution) – we try to keep that updated as we navigate this stuff

We are looking to depart this year on our first year of full timing. We have RVd for 47 years, but never full time. I have looked in several places on the Internet and can’t find a definitive answer to my questions about health issues. I have prostate cancer and am a 22 year survivor, but am currently being treated with hormone shots every three to four months. Is this a manageable issue while RVing? Also, I have a worker’s compensation claim for hypertension. This requires daily medications which I know I can get from chain pharmacies, but I also have to see a cardiologist once a year for re-certification. Do you have any information about how this might work, or should I plan to return to my “home” once a year for that?

Oh gosh.. giving specific healthcare or medical advice like this is way beyond our experience level. Would recommend consulting with your physician about how to go about continued treatments while being mobile.

We are preparing to embark on full timing in our Airstream class B in the near future and navigating the healthcare world with a Florida based address. Thanks for the great video!! From your updates it appears that you are still using the same company. Are you still using Kyle Henson, as well? Would you advice waiting until they are linked with the Escapees?

Thanks for the great site. Look forward to reading your internet handbook and using your apps. E

The Escapee’s partnership is quite exciting (and been in the works for a bit ).. but from my understanding, there’s no need to wait until that is official.

).. but from my understanding, there’s no need to wait until that is official.

I did end up switching my insurance around last month to BlueCross Florida however for various reasons.

I currently have a National POS plan through Humana that has a fairly large network. I used their physician finder of doctors in my network for places we might end up staying and I was always able to find someone close or not too far away. I have ongoing health problems, so it is important for me to be able to use my insurance when we go full time in two months. I just wanted to post about it, because I was surprised by how big the network was and like you’ve said, I have heard that many plans don’t cover out of state healthcare. However, it is more expensive–but I think it is worth it–for me at least. Thanks for the great article!

I really wish you guys would cover low income people when it comes to healthcare. Most workcampers , vandwellers and RVers on the budged make minimum wage, which qualifies them only for Medicaid. Yet you don’t cover any of it on your blogs or videos. You have lost a touch with reality. Not everyone has mobile business with 40-50K income. For single person with income under $16,105 , couple under $20,921, Medicaid is the only option and there are 26 states with (Obamacare) Medicaid that are free for people and every state has different options and regulation. All you guys ever talk about is Subsidies.

Hi Chris.. and thanks for stopping by. We certainly do sympathize with those navigating the complications of Medicaid and mobility – it does add more considerations. They are however outside our scope, as they don’t apply to our experience or those of many of our readers. Our particular niches is specifically the ‘career on the road’ perspective. Medicaid simply doesn’t apply to us.. so we’ve not done the depth of research necessary to feel comfortable sharing. Same as with Medicare for our over 65 readers.

I was going to recommend http://www.cheaprvliving.com as a resource – as their audience is more on van dwellers and low income folks, but even Bob makes enough to qualify for subsidies and it doesn’t seem he’s ‘in the know’ either on the Medicaid situation. But some of the comments in this thread may be of use: http://www.cheaprvliving.com/blog/got-healthy-insurance-open-enrollment-healthcare-gov/ You might also check their forums to connect with others in your situation. I noticed they have this topic on their presentation list at the Rubber Tramp Rendezvous this year.

Thanks Cherie for response. I’m very active on Cheaprvliving.com forum providing folks the info on Medicaid and taxes. I had accounting business for years, mainly working with small businesses but also did individual taxes. I just wish you would at least mention the Maedicaid option and income limits in your healthcare videos for those on low income.

Do you have a link to content written on this topic for nomads that we could point to? Like I said, it’s something that doesn’t apply to us, so we know very little about it – and aren’t comfortable posting about it (and opening up questions about it on this thread, we’re just not qualified to answer). But if there’s a resource out there, we’d be happy to point folks in that direction.

This is the main page that has all the info.

http://obamacarefacts.com/obamacares-medicaid-expansion/

Yes.. that’s the general info. No resources for mobile/RVing folks looking to navigate it?

2 extra comments, even thought its a bit late and the 2015 open enrollment period has ended.

(1) I was amazed to find that almost all Bronze plans on healthcare.gov for PA had **ZERO** out of network coverage. Any costs you incur in receiving health care out of network is not covered and will not count toward your deductible. If you have a plan from 2014 that you’re just allowing to continue “unchanged”, be sure to check this, since ours (Independence Blue Cross Bronze PPO something) dropped all out of network coverage.

(2) That said, my understanding from reading around is that ALL emergency care is required by the ACA to be covered as if it were in-network. It isn’t obvious if there is a clear and simple definition of “emergency care”.

As a final note, and as an unabashed fan of a single payer, non-profit health insurance system, it was bad enough paying 10% of our income last year on a bronze high deductible plan that was basically just asset insurance … but to see the premiums rises by more than 20% and see the coverage drop even more was just beyond outrageous.

Thanks for sharing.. great example of making sure your options/policy in your state will be nomad=suitable, or at least know the risks of taking an emergency only policy.

And open enrollment goes on until Feb 15 for 2015 policies… December 15 was just the deadline to have a policy effective on Jan 1.

I was curious why there is no mention of medicaid in your video?

All 3 , SD, FL, TX, have chosen not to expand medicaid.. which could have made healthcare available to 1000’s of people in these states..

If you are low income, would a state that has expanded Medicare be better ? I mean $450 / mo x 12 mo = 5400 per year.. Shouldn’t that way better than sales tax or income taxes, or insurance rates?

Maybe I’m missing something…

You absolutely have to evaluate the situation for your unique situation.

Thanks for the info!! ,,I know one of my concerns if I wanted to go on the road are expensive asthma medication and access to care. I know I wouldn’t be the only one with this chronic condition but it is always in the back of my mind. I’m hoping the ACA might be able to provide better care then prior.

Many long distance motorcyclist purchase Medjet Assist policies, which will get them “home” after a medical event. I’ve not looked into it myself, but have read the tales of many satisfied users. This does not cover medical costs. It does cover getting you back in network. One of the motorcycle options is getting your bike home too.

There are similar plans for RVers too, and that can be a great supplement for those who have a strong home base they’d want to return to.

This is a really great article that raises some great questions. Especially for the US travelers. We face that problem of not being able to get decent health plans if we drop our US based companies while we travel. There is a lot of though that goes into this!

Great article. Navigating the health insurance waters is not easy, so this is immensely helpful.

We recently domiciled in SD and are beginning to second guess that decision. Having said that, I’m currently leaning towards World Nomads for full coverage, and having Box Elder SD as the point of residency would certainly be a perk as the policy kicks in 100 miles outside of your permanent residence. There’s also no medical deductible that I can see. That’s incredible. Finally, My wife and I are 30 and without per-existing conditions and so I think a $100,000 limit would cover most catastrophes. If we came down with something more serious, and I still need to some research here, I believe we could sign up and get some type of coverage through the ACA.

Excellent article, as always (and thank you for the very nice mention!). Although I’m constantly reading up about this I learned some new things in this post (that’s what I love about reading blogs!). Never hear of TelaDoc and adding that to my “list”. Also very intrigued by the whole World Nomad option. I’ve used them for international travels, but it never occurred to me to buy a local insurance via them. Worth looking into I think.

And your comments on SD are spot on. There is no doubt we’re moving domicile next year and it’s precisely because the health options in SD are so poor.

Nina

I am a resident of Washington state. I’ve found that the vast majority of individual plans offered on my state’s insurance exchange do not have a out-of-pocket limit on out-of-network care. So if an accident or illness occurs out-of-network, I could potentially be exposed to potentially unlimited expenses. Also, there is no out of country coverage on most plans. These are BIG changes from the individual plan I currently have. The one provider on the exchange that still has an out-of-pocket limit and out of country coverage does not cover any of my medical providers.

On the plus side: going through the exchange, I will save a little over $600 a month on my premium! And there will be much lower in-network deductibles, co-pays and co-insurance. The savings are too much to ignore.

I will be looking into World Nomads travel insurance for the times I am out of network for extended periods. (Thanks to Amy Kaplan for that idea).

As for prescriptions, Walmart and Target both have a list of 400 generic drugs available for $10 for a 90-day supply. This is less than the co-pays on my current individual plan, and I can arrange for refills at any Walmart or Target pharmacy in the country. I anticipate I will continue purchasing my prescriptions this way.

I too am intrigued by the World Nomad’s option giving an ‘away from home’ supplement. It could allow folks to concentrate their ‘good’ health insurance plan in their state of domicile (assuming they return there often enough to use it).

And great point about the generics offered by many stores.

I currently have travel insurance through World Nomads. It’s not health insurance, persay, but it covers any and all medical needs while traveling–which they define as 100 miles from “home,”at any time. I have yet to file a claim so I don’t know if they are really going to do what they say. You get $100,000 for medical occurrences of any sort. I am going to be filing a claim shortly.

http://www.worldnomads.com

I’d rather have regular medical coverage but I am finding it all to be a morass I can’t navigate and can’t afford– ACA or not. We really need a one-payer system and leave it at that. (I guess that’s a political comment. I don’t mean it to be. It would be nice to just know care is there when you need it regardless of who you are covered with, etc.)

Lastly, I have found that the cash price for services is 50% less then the insured price– which is on-the-ground evidence of how inflated health care costs are.

Great to know that World Nomad’s now covers domestically. I don’t think that was the case when I first wrote this article a few years ago. Thanks for the update, that can be a great back-up option to go along with an ‘in state plan’ to cover costs to get you stabilized until you can go ‘back home’ for follow up care.

Thanks for the well thought out ideas. Like another comment, I thought Blue Cross had me covered when I was run over by a 38 foot boat in a swimming area in Ft Lauderdale while on my first day there!! After the lawyers were finished, the citizens of the state of Florida were left with the bills and I was destitute.

Now days we are covered anywhere by GEHA, Medicare, and DAN. (Divers Alert Network, check out their travel insurance!!)

Just a word of Warning… I had Aetna for the 10 years prior to a major life changing illness… if you have them, make sure you have a personal secretary to keep up with their paperwork if you ever have a major incident… and a lawyer that is ready to go for blood… For even if it is covered they will deny the claim if you cannot keep up with their paperwork requirements.

I had a “Cadilac” plan with them… thought I was covered… they bankrupted me in 90 days.

Michael

Oh, and I was a “Nomad” at the time… An over the road trucker… I got ill outside my home state, too ill to be transported… something to keep in mind most policies even that offer coverage outside of your “home” state… LIMIT the amount of time and coverage allowed away from your home state… So, if you pick a state and need longer term care… you MAY NEED TO RETURN AND STAY at that state of Residence you have chosen. Something else to keep in mind.

In my case I actually lived in Alaska… but, ended up in ICU in Oregon… FOR MONTHS…

All individual insurance plans scare me for this reason. There are so few consumer protections, and us individuals have very little advocacy to draw upon when we need it most.

Thank you for sharing your real life example, and sorry you had to go through it.

Thank you so much for writing this. I currently have retiree medical through my former employer, but I will not be surprised if it’s cancelled. We realized early on from reading another blog that we could no longer be SD residents, but didn’t know where to go. Florida is now looking good to us, due to the availability of insurance. I never thought I’d see the day when I would be looking forward to Medicare which is totally portable.

Totally agreed on the portable insurance thing – at least there are some nice perks for getting older awaiting us.

Very timely! I’m just deciding where to domicile while full-time traveling, and researching health insurance had already made me reconsider SD. Between this and the “companion” posts made by Wheeling It, I think I’m on the right track in deciding on a different state (but.. which one!). I’m feeling the pressure of the December 15 application due date for insurance starting January 1.

Like you mentioned, I’m also considering states other than the usual, no-tax ones. “Luckily,” my income is such that I’m not in a very high bracket anyway. OTOH, both FL and TX have great support in very good mail forwarding, etc. (i.e. St. Brendan’s Isle, Escapees, etc.). That seems like a huge advantage over other states where one would…. what… just use a UPS store or something (?).

Thanks again for SUCH a great post. Really fantastic, and you obviously put a lot of time into it.

It’ll be a balancing act, for sure. When considering other states be sure to look at the whole picture. Do you need to live in the state a certain amount of time? Vehicle registration/insurance costs, driver’s license logistics, jury duty exemption and any other impacts on your life. Our domicile chapter lists a whole bunch of considerations – https://www.technomadia.com/domicile .

Cherie

thanks for the update. Recent full timers this year, we are in the midst of trying to figure this out so this as well as Nina’s blog is helpful and well appreciated

So happy it is helpful.. we try to share what we learn so others can reduce their headaches. Nina provides such a thorough and detailed resource – we had a great time comparing notes in a hot tub a couple weeks ago on this stuff.

Yes Nina does rock, but as I have said before you folks also rock.

I want to be a nomad some day, and this medical information is perfectly suited to questions I have been facing as I research what I will do for insurance. Since my plan is to work on the road, the decision of where to call my Domicile has been Texas.

But as I am in California, at this time I am eligible for MediCal, so I have more research to do to find out if I leave Cal. I would be covered for emergency situations and return to Cal. for checkups.

Anyway Thanks so much for all your hard work, and all this great information.

BTW I had no Ins. when I got hit by a car on my scooter, my hospital bills are now at about $90,000.

Thank you for sharing such an important reminder, Roger. No matter how well you take care of yourself, big medical expenses can still come up.

Best wishes as you navigate this stuff.

Great post. I just want to remind all veterans out there to sign up with VA to receive your health care. It is alarming how many do not sign up, and it is considered as insurance, so have your vet sign up. Steve

Excellent reminder, Steve. Thank you!

So sad that the headache I have developed from looking at all these health care plans will not be covered. Thanks for all the great info on health care and other great traveling info! We’ve been self employed for years now so finding a health plan has been a yearly endeavor. However, the previous years we have had a sticks and bricks house in Rochester, NY and have been able to join a chamber of commerce to get the group health care rates. As of July 1st we are officially full timers as we sold our home and everything and now I am searching yet again for health insurance. We are FL residents now thru St. Brendan’s Isle, like you. We’ve been using them since 2008 for our mail forwarding when we were traveling, so it was a natural progression to use that address for our permanent domicile once the house sold. Without being chamber of commerce members anymore, we are searching for individual health insurance and boy, is that fun (she said sarcastically). Thanks again for all the great info.

Indeed, us self-employed folks have danced this dance many times. It’s just another tune Let us know if you guys come up with anything interesting in FL as an option.

Let us know if you guys come up with anything interesting in FL as an option.

The Fit Bit gadget’s a great idea! Thank you for all the info. Got to hear all about your fire dance from Deb and Greg while I was attending their workshop last week. Sounds like they had a great time with you. Good energy!

Oh, how did the workshop go? So wish we could have stuck around the PNW to attend ourselves!

And yes, those two have great energy indeed, we very much enjoyed connecting with them. And know we will with you two as well!