<— Read Chapter 9: Picking a Domicile State, Getting Mail & VotingRead Chapter 11: Approaching the Overwhelm of Preparing for Full Time Travel —>

Being nomadic doesn’t necessarily mean divorcing yourself from the economy, forgoing being a tax paying citizen or giving up saving for the future. While you’ll likely eliminate many bills, you’ll still have expenses to pay. You’ll still have taxes to pay and file. You’ll still have a budget to follow.

This chapter will focus on the logistics of handling money on the road. Of course before you can worry about how to handle your money, you might want to learn how to Earn a Mobile Income and Afford Full Time Travel.

Just a note – throughout the article below we link to several financial institutions that claim to offer the features we talk about. We have not tried them all, and do not necessarily endorse any particular account. We provide the links to give you a place to start your own research. Feel free to leave comments on this article about what works for you, so that others might benefit from your experience.

Banking – Checking & Savings

Handling money on the road has become much easier over the years. There are more and more options available for comprehensive online banking, allowing many nomads to wander without worrying about how they’ll access their funds. However, there are still many things to consider to make sure you have everything setup to handle your traveling lifestyle.

Your options range from nationwide & international commercial banks with a physical presence (Chase, Wells Fargo, Bank of America, etc.), online only banks, credit unions or living totally off cash & refillable credit cards.

Some of the key features you might want to look for include:

Easy Transfers to Outside Accounts

If you settle on multiple banks to meet your financial needs – which we think is a pretty good idea – then you’ll want to make sure your institutions give you easy ways to transfer funds between them. Some call this ‘External Accounts’ or ‘Linked Accounts’. Be sure to investigate how many they allow to be attached to your account, and if there are any fees involved for transfers. In general, you can initiate a transfer of funds that show up in your other account within 2-3 business days.

We do strongly recommend keeping accounts at multiple unrelated financial institutions, especially while traveling. So many things can happen while out on the road that might cut off your ability to get at any given account – ranging from having your account login info compromised to your bank suddenly going out of business.

While ultimately things will probably end up sorted out without any actual financial losses, the mess of logistics required to regain access might leave you in financial limbo for days or even weeks. Having a secondary account ready and setup can prove to be a trip saver!

Online Access

Most banking options these days have an online component. Some are really quite robust, and some really quite lacking. When selecting a bank, see if a demo of the online interface is available to make sure it gives you everything you think you’ll need to manage your finances online. Unlike living down the road from your financial institution’s branch, you won’t be able to just walk in to take care of transactions. If you can’t get a demo and still do open an account on faith, don’t hesitate to close your account if you’re not happy and try again elsewhere. A crummy online experience isn’t worth living with.

Another tip – spend a good bit of time navigating the institution’s website from what your typical internet connection on the road might be. If it’s particularly slow to load, it may be frustrating to use while on the road. As much as we prefer to support smaller banks and credit unions, some have awfully slow and bloated sites, and many don’t have the funding to put as much infrastructure into their online services.

We also favor banks that make setting up & closing accounts easy online, instead of needing to handle paperwork in person, fax (they still have that??) or via the mail.

Smartphone Access

Most banking institutions have their own mobile app for iPhone and/or Android. Many banks are rolling them out, giving you safe access to your accounts even while you’re away from your computer. Some allow you to transfer funds, pay bills, check transactions, pay others, find their ATMs or even remotely deposit checks.

Those that offer it tend to proudly display this on their websites, so it should be fairly easy to check this one off the list if it’s important to you.

But try the app first, and check the reviews! There is a lot of extremely underwhelming apps out there.

Depositing Funds

While you think that going nomadic might mean a paperless existence, we’re constantly surprised with how often we receive those funny paper checks. Investigate how the institution expects you to deposit checks into your account while you’re out roaming.

Can you deposit via an ATM? Only at a branch? Must you mail the check in? Can you scan the check and upload it online?

Or even better, does their mobile app allow you to snap a phone camera picture of the check and deposit it from anywhere?

Chase, Bank of America, USAA, Capital360 (formerly INGDirect), Charles Schwab, State Farm, Everbank, US Bank, Simple and some credit unions are amongst the ones currently offering mobile apps with check deposit built in. And more seem to be popping up regularly. Be sure to check:

- The conditions under which the feature is offered – such as eligibility and account minimums.

- What the per transaction limit is, which may not be immediately disclosed upfront. It can be most frustrating to receive a check for $1100 and then find out the mobile deposit limit is $1000 – causing you quite a delay in having access to your payment.

This feature has been extremely valuable to us in our travels. When we’ve had clients want to pay us via check, we’ll even have them email us a decent scan or photo of the front & back of the check, and use that to handle a remote deposit. It works very well, and vastly speeds up the time it would take for a check to reach us via regular mail.

We find this to be an important feature not just for handling paper checks, but also for more quickly managing external account transfers. Electronic transfers can take 2-3 days, while a check deposited by SmartPhone may take less than 24 hours to become available. So if we need to quickly move funds around, we’ll sometimes just write ourselves a check instead.

Another option is having checks sent to someone you trust to handle deposits locally for you. We do this particularly with client payment that exceed the limits of remote deposit. If we had them sent to our mailing address, it would add a few weeks before they caught up to handle ourselves. So instead, we have certain clients mail payments to our office manager (aka Mom) and she handles the deposit for us.

ATM & Cash Access

You’ll be roaming around and probably need some cash from time to time. But more than likely, you won’t always have easy access to one of your financial institution’s own ATMs. This can translate to extra fees to get cash at other bank’s machines.

Some banks are aware of this and will actually reimburse you for any ATM fees regardless of which ones you use – Ally, USAA and Everbank are amongst those that do. Charles Schwab actually reimburses for ATM use around the world – a great benefit for international nomads. Others are aligned with extensive ATM networks that make them quite accessible. CapitolOne360 for example uses the AllPoint network, which has ATMs that can often be found in many retail locations such as grocery stores, Walgreens, Target, CVS and 7-11.

For credit unions in particular, some are part of an alliance that gives you access to your account for cash and deposits at any credit union ATM that is part of the network. So if you’re eligible to join one, this might be a workable solution.

And of course, you can always get cash back on purchases at grocery stores if you use your debit card.

Paying People and Being Paid

So how will you get money out of your account and into the hands of those you owe? Of course there’s checks, which as RVing nomads we seem to write a lot of, such as to campgrounds with self pay stations.

So how will you get money out of your account and into the hands of those you owe? Of course there’s checks, which as RVing nomads we seem to write a lot of, such as to campgrounds with self pay stations.

But we love paying people electronically whenever possible and consider a peer-to-peer payment option an essential bank feature. On Chase it’s called ‘QuickPay’, on CapitalOne360 it’s ‘P2P’ and Ally Bank calls theirs ‘Popmoney’.

These are built in payment options that allow you to directly transfer funds to another person’s account regardless of what institution they’re with. Some require you to have their account info, and some just their e-mail address. And some with mobile apps allow you to reimburse folks in person. These are ideal options for transferring funds with folks you trust – friends and family. We also regularly use this service on our small business account to pay our sub-contractors. Often these services do not have any transaction charges, which is why we prefer them. They also work in reverse, allowing you to receive money from others – we can also take payments from clients this way.

There’s also options of using an external service like PayPal, Swipe, Dwolla or Venmo – where you externally transfer funds into their service, and then designate payments to others. And, you can also generally use your credit card for payment – giving you a double layer of security. These are safer options particularly for dealing with merchants or individuals you may not directly know, but also may have fees involved with them. And sometimes this may be the only feasible and quick option for dealing with international transactions. These services also allow you to accept payments from others, making them ideal to use when selling stuff.

For instance, we use PayPal for directly selling our eBooks, signing up new members to our RVMobileInternet.com site and taking smaller payments from clients.

And it’s never been easier to accept credit card payments than now – as with services like Square, and PayPal Square you can easily set up a no monthly fee merchant account and accept payments right on your smart phone. Perfect for mobile vending.

If you need to set up a more elaborate invoicing system to accept payments from clients, there are services like Bill.com and Intuit.com.

Before you set off on the road, you might want to think about how’ll handle a large transaction, and how quickly you can get access to your liquid assets. We’re constantly surprised by how often this has come up in our travels – from needing to buy vehicles & RVs, putting down a deposit on a rental with a remote landlord or perhaps a major repair bill. Sometimes, a merchant just won’t accept a non-local personal check and we’re left needing to come up with cash, certified check or wiring funds. If your bank isn’t nearby, is online only or it’s after banking hours, this can be problematic.

Here’s some of the situations we’ve encountered:

-

Our St. John Island Jeep — paid for by an ING P2P electronic transfer. We arrived to the Virgin Islands in 2010 and needed by buy an island Jeep from a private individual. He didn’t trust that once he got the payment notification from ING (now CapitalOne360) that the money was withdrawn from our account and would arrive in his. We ended up having to wait a couple extra days to get our Jeep until he saw the money in his account. (Before we left the island, we just sold the Jeep for cash. It was far cheaper to buy/sell a vehicle than renting for 5 months.)

- When we needed to unexpectedly trade in our tow vehicle for a newer truck – our funds were mostly in ING/CapitalOne360, who at the time didn’t issue checkbooks. And nor do they have instant wires. There wasn’t enough time to get the funds transferred to our Chase account, so we ended up taking out a loan so we could drive the truck off the lot that day (and then paying the balance off).

- When we started hunting for our bus we thought ahead and put a sizeable amount into our Chase account to give us more flexibility. Our eventual seller however wanted cash only, no discussion. Thankfully Chase had branches in Arizona. Unfortunately, the closest branch didn’t have $8k in their drawers (seriously?!?!), so they sent us scurrying across town to a branch with more cash on hand.

Fees and Rates

And of course, we want all the features, while paying no fees… oh, and throw in some interest on our deposits too! Just be sure to fully research the features of the bank beyond their fee structures to make sure you’re getting a solution that works for you.

Also, don’t choose on current fees alone. We’ve definitely been put in the situation of setting up our accounts and then a year or two later having the terms fundamentally change. Trying to re-arrange all your accounts can be frustrating sometimes leaving you feeling trapped and betrayed by your “free life time (or until we change our mind) checking” bank. Chasing the absolute best fee & rate structures sometimes is just not a worthwhile endeavor – better to focus on quality, stability, features, and service.

Patriot Act Address Verification

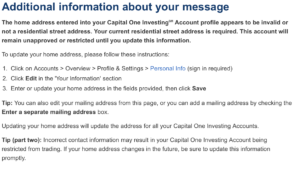

The Patriot Act now requires that financial institutions have a residential address on file for each of their customers, and it explicitly excludes the use of mail forwarding addresses for this purpose. Routinely, institutions are subject to internal audits to make sure they have these addresses on file, so whether you have an existing account or a new account – you might get caught by this.

And if you do get caught, the institution can freeze/restrict your account from any transactions until you fix the situation.

While the Patriot Act does specifically allow for using of a family or friend’s address for this purpose, different institutions are enforcing this requirement differently.

Here’s our personal history with dealing with this:

-

We’ve had this account for over 10 years, without problem. But it wasn’t until we went to make a routine trade that we were told the account was restricted waiting for a residential address. Most of our banking institutions just popped up a message on login asking for a residential address. We entered it, and were done with it.

- We’ve had one physically call us to get the address. Again, gave them our address and were done with it.

- We had one send a ‘secure message’ that they needed our residential address, but it wasn’t until we logged in a month later to make a trade and were told our account was restricted that we even knew about it. It took 3 business days for them to approve the address and get the account released. ANNOYING!

- We have run into pretty major problems with Charles Schwab, who would not accept a family member’s address unless we also provided proof in the form of utility bills in our name at that address. They did however say we could use a RV space lease agreement’ instead, but that was not possible for us at the time as we were not in one location for any length of time.

We recommend having a residential address ready to give your financial institutions – whether it be a family members or a friend. Try not to divulge too much information about your traveling status, as they’re really just trying to fill in blanks on a screen. Any confusion you raise could result in difficulties with your account that are just best avoided.

We are now personally officially listed as tenants on a family member’s lease so we can legally use her address in Florida (our state of domicile) as our residential address. This also enables us to live with her long term should the time come for us to care take for her.

Keep in mind your domicile intentions, as having an address on file at a financial institution that is not in the same state as your domicile could cause future problems should your residency status come into question. If you use a family member’s address in a tax aggressive state, you could find that state coming after you for taxes or registration fees in the future.

Some Other Nomadic Banking considerations –

While banking as a nomad keeps getting easier, there are some things to keep aw

- Some institutions are more nomad-aware than others. For instance USAA and Navy Federal are credit unions for military families and is used to dealing with folks who move around a lot. And Alliant Credit Union has an affiliation with the Escapees RV Club and is quite mobile friendly, and apparently one of the few financial institutions that will finance RVs for full timers without a physical garaged address.

- If you’re intending some international travels, be sure to select a bank that has you covered around the world. HSBC is a popular worldwide banking option as they have locations all over. Charles Schwab is popular for their worldwide ATM reimbursement, and USAA as they support military families around the world. There’s reports that primarily online banks like Capitol360 also work quite well internationally too. Some nomads have reported difficulty with using services like PayPal, referencing account lock outs when accessed from varying locations (we’ve encountered this a few times ourselves just using it across the US.)

Credit Cards

A lot of folks are very anti credit card, and with good reason. Without discipline, it can be easy to quickly get yourself into a heap of difficult to pay off debt. They have high fees that get worse the deeper into debt you go, and encourage you to pay minimum payments that will leave you in debt for many years.

A lot of folks are very anti credit card, and with good reason. Without discipline, it can be easy to quickly get yourself into a heap of difficult to pay off debt. They have high fees that get worse the deeper into debt you go, and encourage you to pay minimum payments that will leave you in debt for many years.

We are debt free and think credit card debt is an evil cycle. But we are not anti credit card when they are paid off in full monthly.

They can be utilized to your advantage, and we find them pretty darn useful – if not essential – for our full time travels.

So many services you’ll need as a traveler are simply difficult without a credit card. Booking flights, trains, hotels, rental cars and more is just so much easier if you have a credit card to put it on. And of course shopping online pretty much necessitates a credit card.

Here are some of the advantages that credit cards have for a traveler:

- Travel Insurance – Many credit cards provide insurance for disruptions in travel and accidents that might occur, including medical evacuation. Some even provide rental car full coverage, meaning you can decline at the counter.

- Ease of payment – Us nomads are frequently doing business remotely, and need an easy way to pay for services, reservations and things.

- Extended Warranties – Many credit cards provide a vastly extended warranty on many items you purchase. So your new camera may now have a 2 year warranty, instead of the manufacturer’s 1 year. Some even have accident insurance, such as when that new camera somehow ends up in your cat’s water dish (not that we know anything about this).

- Concierge Services – Some brands, such as Visa Signature (issued by many different banks), provides a free concierge service. Just call them up to help you out in just about any situation – from finding a supplier of a vat of nacho cheese sauce for a party, or locating a dentist with an immediate opening to fix your infected wisdom tooth. As travelers we sometimes just don’t have the local connections to find services when we need them. They’ll do the research and calling around for you.

- Disposable Numbers – Some cards come with a feature to generate a one-time use account number for online shopping, which can significantly reduce your risk of your account be compromised.

- Rewards – If you select a rewards credit card and you pay your balance off in full each month, you can actually make money off your purchases! We’ve selected a card that rewards cash back on our frequent sorts of purchases of fuel and groceries. But there’s all sorts out there, and some reward in airline miles or general points you can redeem for a variety of things. (One argument against credit cards is that we all pay increased costs as merchants pay a fee to accept them. If there’s ever a cash discount that exceeds our rewards percentage, we’ll take it instead.)

- Consumer Protections – This is probably our biggest reason for using a credit card whenever we can. If our card number gets compromised and unauthorized purchases are being made, we know fairly immediately (we download our transactions daily into Quicken Essentials – read here for why we no longer rely on Mint.com). All we have to do is log on to our account and report them – and they’re taken care of. We’re not responsible for a cent of it. Unlike if you use a debit card off your checking account, your entire cash balance could be compromised before you even discover there’s a problem. Also, if we have a problem with a merchant not delivering as promised, we can refute the charge and let the credit card company handle it.

We do choose to carry multiple credit cards, as we’ve encountered a fair number of difficulties. Such as our credit card company locking our account down because we’re charging in a new location – despite this being ‘normal’ and us telling them multiple times that we travel full time. Also with filling our 140 gallon diesel tank at the pump, many pumps cut off after $75-125 and won’t let you re-run the same card more than a couple times. There’s ways around this of course – such as using truck lanes and/or paying inside.

If you’re still not comfortable with using credit cards, there are other options of course. Some folks we’ve encountered load up refillable credit cards with cash, and then use those when they’re needed. And some folks somehow manage to survive by using just cash and checks.

Our current personal banking arsenal

For our personal banking, we currently have our checking and savings with Capital One 360 (formerly ING).

We love them, and they keep adding features that make them ideal for nomadic life. They’re totally online, have easy payment options to others and transfers into our other accounts. Their iPhone & Android apps allow deposit by phone. And Capital360 now allows you to have an actual checkbook, which is super helpful in paying campground fees at self pay stations. CapitalOne360 has no account fees and no minimums, and is interest bearing.

We also keep a small personal savings at Chase so we have some access to a bricks and mortar fairly nationwide bank for free notary service, cashing savings bonds and cash access.

The majority of our daily expenses however gets charged to our rewards based credit card which gets paid monthly from our checking account. It never carries a monthly balance, we never incur interest charges or fees and we earn about $30-40/month in cash rewards plus all the other consumer protections. We charge most everything we can to this card – fuel, groceries, dining out, household shopping, cell phone bills, campground fees, etc. We keep a back-up joint credit card, a card we only use for online shopping and each also have an individual card.

For business, we also use Chase. Aside from their smartphone app that lets us deposit checks remotely, we love their QuickPay feature which lets us send and receive payments electronically with no extra fees. Super handy for paying our contractors, and some of our clients use it to pay us. We use PayPal for our membership site, as well as sell through online stores like Apple, Google Play and Amazon for our books & apps.

Getting your Finances in Order

There’s a common assumption that you have to be absolutely debt free and have a ton of savings to hit the road. And we’ve heard the excuse over and over again – “I’ve got too many debts and no savings.”

Debt

For sure, being debt free is its own source of freedom and gives you tremendous agility and choice. Many folks who choose a nomadic lifestyle have also worked to earn their debt free status and built savings (us included). But we consider these separate lifestyle goals.

The fact of the matter is, living on the road – cost wise – really is financially similar to any other lifestyle choice. You have living expenses, period. And you need a way to pay for them.

When you travel full time, those costs generally take the place of what you might have previously paid for your housing costs – and sometimes they can even be cheaper and give you more flexibility to ride the feast and famine of income sources. There’s no set amount it costs to travel full time – it all depends on your style and preferences. While some budget travelers blog about living on under $1000/month, it could easily cost a luxury traveler $10,000/month for their style. We openly share our monthly costs, but it’s only one data point and does not in anyway indicate what it might cost you.

Unless you’re retiring, taking a gap period (ie. being more on extended vacation than becoming a working nomad), just inherited a trust fund or are going on a very ultra-minimalist mission – you’re probably going to be setting up some sort of mobile income source. We covered over 60 ideas for this in Chapter 1 of this series. You just need to be sure that your mobile income source will cover the lifestyle you want, including any debt repayments you’ve racked up.

If travel is calling you strongly and you can otherwise figure out the rest of the logistics, we see no reason to put your dreams off until that elusive day that you’re debt free and can afford to pay for everything in cash. A lot can happen in that time period, and who knows what other blocks might come up for you – health issues, family issues and more.

You can live mobility, earn an income and continue to pay your debts down. Just like you can now living in one place.

But please note – we don’t encourage creating new debt, or shirking your responsibilities. And we strongly advise living well within your means, no matter your mobility status. And we do encourage striving for paying off your debts, it is a wonderful feeling to not have them hanging over you.

Savings

As far as having a massive savings account – sure, that makes navigating life’s many hiccups easier in any lifestyle. There’s a lot of freedom in knowing that you can handle any reasonable financial obstacle that comes your way by tossing some cash at it, and that you don’t have to take just any gig because you can live off savings for a while.

But that doesn’t mean that to be nomadic you need to have lots of savings. Unless of course, you don’t want to earn an income anymore and will be living off your savings.

But if you’re living your life now without much of a cushion, it’s really not all that different living on the road. Unexpected expenses come up. Appliances break, pets get sick, engines need rebuilding, emergency trips ‘back home’ come up and sometimes you just need a pampering day at the spa.

How do you handle these things now? Sometimes you get creative in finding other solutions (bartering, fixing it yourself, etc.), you put things off until you can save up enough, you might put the expense on a credit card, you rob a convenience store (joking!) or you just work harder to bring in the funding you need. The same would be true on the road.

How much savings should you have to hit the road? Well, that will vary by your own comfort zone and expected lifestyle. We know folks who set off with none, and some with millions. Most of us are somewhere in between and not even close to millions. If you’re also embarking on self employment after years of a steady paycheck, we do recommend having enough savings to survive at least a few months – learning the navigate the waves of feast and famine as an entrepreneur takes time.

Just like in any living situation – you can continue saving as you roam. Just spend less than you earn, and sock the rest away. (It really is that simple.)

Tax Considerations

Taxes is a very complex topic even without tossing in nomadism, and there’s no way we could cover all scenarios here. So let’s start this off by saying that you should definitely consult a nomad-aware tax professional and/or business attorney for any specific advice you might need. Do plenty of research to make sure you’re handling things as best you can.

We’ll only be talking in generalities here and pointing out some things you should keep in mind. We’re definitely not qualified to offer any specific advice on this topic.

State Taxes

We’ve already gone over selecting a state of domicile, which includes state level tax considerations.

You’ll also need to consider various state tax laws, where you might end up owing state income taxes, needing special permits & licenses to work in a state and payment of sales taxes on products/services you might deliver.

Also be careful of when a state might want to claim you as a resident if you’ve worked in the state for a specific amount of time.

These things can get complicated quickly, vary widely by both state & industry and can have some expensive consequences.

Federal Taxes

However American citizens will still need to navigate federal taxes. To the government, there is a difference between your state of domicile and your residence (where you live). You’ll use your domicile address on your personal taxes, and we find filing online to be the easiest way to handle this.

If you’ll be traveling and earning an income internationally, research some of the tax considerations with this situation – you may be exempt from paying federal taxes if you’re outside the country for a certain amount of time.

For us domestic nomads, the federal government actually does recognize us nomads as transient tax payers and considers our residence to be where we’re currently living (not your domicile address).

If your RV is your home, then you’re currently living where your RV is parked.

A common thing people incorrectly assume – ‘Wow, you work on the road – that means you get to write off all your RV expenses!’.

Which is not true at all.. as technically you’re only allowed to write off travel expenses while traveling away from your home & business base. In most situations, you’ll likely not be able to deduct mileage traveled in your home/RV (there may be exceptions, again, consult a professional on this.) The miles you can write off are in your non-RV vehicle for commuting to/from your RV Home to work locations – such as visiting a client, doing research, attending meetings, attending events, etc.

And while you can take a home office deduction for space in your RV that is used regularly and exclusively for business, it’s very hard to prove in a small space like an RV. And in the end, the potential write-off generally just isn’t worth the effort or risk.

In August 2014 there was a court ruling about mixing personal and business use of a RV, although not as specifically applied to a RV being claimed as a permanent dwelling. This ruling does pretty much make it difficult to write off things like depreciation, maintenance, improvements, etc. as business expenses if you use your RV for personal use more than 14-days a year.

There’s also the potential complications that if you start claiming business expenses in your RV, you can run risks of your RV (especially if it’s a heaver motorhome) being classified as a commercial vehicle and now needing a CDL (commercial driver’s license), regular medicals, business RV insurance, going through weigh stations and more.

Us nomads are in a tricky area, and there’s not been tons of precedent to give clear guidance.

We probably lean more on the cautious side of the scale as we’re happy to pay our fair share of taxes and write very little off, and others may be far more willing to push the edges. Do your own research on this, consult a professional and decide where your comfort level is.

For more information:

- Tax Queen – Heather Ryan is a full time RVer and registered agent. She has a ton of free resources, and is available for hire too.

- Escapees RV Club Accounting Tips Series – Written by a full timing CPA, with tons of awesome info explaining all this

- Tax Benefits of RV Ownership (by Howard Payne of RV-Dreams, former lawyer & accountant)

- RVing and taxes by a long time RVer and tax professional that answers many questions about this subject.

A couple notes specifically about RVs for nomads.

- Yes, if it is your primary or secondary home, in most cases you can write off the interest on a loan that the RV is secured with.

- Yes, if your RV is your primary home – you can take solar energy credits when you install such a system.

<— Read Chapter 9: Picking a Domicile State, Getting Mail & VotingRead Chapter 11: Approaching the Overwhelm of Preparing for Full Time Travel —>

What happened to the eBook version of this series?

We used to offer an eBook version of this content on a ‘Pay as you Wish’ basis. That book got so out of date and we have no time to keep it updated – so we took it down.

We do our best to upkeep the segments in this blog series, but realistically can’t see republishing the book edition.

In November 2018, RV Love released their brand new (professionally published) book – Living the RV Life. It goes over a lot of similar content to this series (and more) on RVing. We highly recommend picking up a copy!

You’re of course welcome to browse the No Excuses: Go Nomadic series online for more of our tips & tricks on the logistics of nomadic travel.

If you do appreciate this series or the content on our blog, we always LOVE hearing your appreciation – leave a comment, leave a tip (link at bottom of every page) and/or share this post. Thank you!

Best blog I have read so far on this topic. Thorough and it answers important questions that are best resolved prior to heading ou on the road. Thanks for a great article!

We are in the process of changing all of our mail and banking accounts to our new mailing address at SBI. The 1st credit card I changed (AMEX) immediately sent me a letter telling me that this was not a valid address and that I needed a residential address. At the time (2 months ago) it wasn’t a big issue. My parents RV and lived part time in a RV community that they owned in Florida so I used their address. They have just sold it so now I need a new residential address in Florida. I do have a few options and my question is (sorry for the long preface) will they (the banks, Charles Schwab, etc.) send my statements to the residential address or my SBI address. I was curious what your experience was. I don’t feel that I can trust my residential options to forward my mail. TIA.

With our institutions, the residential address just needs to be on file. The mailing address remains our SBI address.

We’ve used Suntrust Bank over 20 years and will continue to when we go full time. They offer all the online and mobile services mentioned and it all works very well. Happy RVing!

I am a weekend/part-timer and work for a large credit union in Ohio- Seven Seventeen Credit Union. I am also a happy member. We are RV friendly, with all of the great mobile banking products mentioned in your article and we provide financing for RVs, too. Thanks for the positive credit union words in your comments.

I am a bit confused. Is your domicile state, Florida and St. Brendan’s Isle, not enough to satisfy the Patriot Act requirements? Must you use a relative’s home address?

The Patriot Act specifically disallows the use of mail forwarding services for this purpose. You *should* be able to use a relative’s address, however Charles Schwab told us they have corporate policies against it unless you can prove you actually live there by providing utility bills, etc.

Solar energy grants and credits offered by individual states may not apply to an RV. A good source of information on this would be a professional solar installer in the state where your taxes are paid.

Their businesses often depend on huge grants from their state. In Wisconsin many smaller solar installers went out of business when the recent administration cut the solar grants that were paying up to 50% of a solar install cost.

The reference to solar credits was for federal, not state.

I’ve been happy with a Capitol 360 checking. Its been everything promised. My daughters have the same account and we can instant transfer to each other, or to any one with a 360. One can transfer to any checking outside the bank in two days, all free. They say they are close to allowing cash deposits from any ATM. Meanwhile I can still transfer from my out side. “land based” checking account by online command.

Thanks for all the great information you’ve shared here. It’s mich appreciated.

Do you feel it’s best to have the business account, into which money (payments) received will be deposited, in a different bank that the other personal accounts? Thereby keeping a very distinct separation of account types? (Personal vs business)

Or maybe you feel there are advantages to multiple accounts with one banking institution?

Thanks in advance for any input you may have. 🙂

I don’t know that there’s any specific advantage to using different institutions for distinction.. just having different accounts for business or personal should be enough. In our case however, we couldn’t find an institution that offered what we wanted in a personal account and a business account (we like CapitalOne360 for personal, but they don’t offer business accounts.. as an example.)

Thanks for the reply, Cherie. It sounds like having accounts at more than 1 bank will be a best practice. Just need to be able to move funds from the biz account to each personal account at will.

Thanks again.

Another real gotcha now is that current US Department of Transportation rules require you to have a commercial drivers license and possibly a DOT registration for your RV (weight and/or seating related) IF you use the RV for any business purpose including traveling to a business function. This gets really picky — for instance, taking your son to a go-kart race where he might win a cheesy trophy counts as a business purpose because the trophy has “value.”

The DOT regulation applies to interstate travel and, I think, use of federally funded or partly federally funded highways. Apparently some states also have this requirement.

welcome to 1984.

edward

Do you have a link to more information about this? It’s the first we’ve heard of it, and we tend to monitor RVing forums and groups pretty closely.

Some of this stuff we do and practice. We bank with Navy Federal and USAA and we have a local bank at our home base so we can have access to a real person if we need to. We have the ability to transfer funds to all and we also use a smart phone to do deposits. I did not know about the Patriot Act Address Verification the the exclusion of a mail forwarding address. We will have to work on that issue.

Alternative Resources, in Sioux Falls SD, has changed its name to Dakota Post. They are also moving to a new address. One can only change their address on the drivers license by going to SD. So – any new bank transactions with the South Westport address on the license may be difficult. That’s the picture ID, with an incorrect address.

Thanks for the update.. that’s pretty big news, and will definitely affect a lot of folks. It’s like being forced to move. With all of the healthcare policy limitations in SD also happening, I would imagine that will have an impact on people’s decision stay in SD or switch to another state.

Another outstanding and helpful article. Thanks for the time and effort.

Earlier this year, the small, local bank we’ve loved for years was gobbled up by a much larger institution with ridiculous fees and lousy customer service. While looking for alternatives, we were fortunate to discover Baxter Credit Union. Wonderful service and all the remote features. We seldom visit the branch, and then it’s just to say hello. This CU definitely works for us. Previous experience with predatory fee structures makes us leery of the big players, especially B of A.

Wow , your articles are so helpful and so well done. Thanks for sharing your knowledge and experience. Ps . We are close to going on the “road”. Mark

Another long-term Wells Fargo customer here. They also allow mobile check deposit (phone, iPad etc.) which we’ve used and integrate easily for online transfers to our various investment accounts.

Excellent & detailed article, as always.

Nina

When we were re-shopping for possible banking solutions a couple years ago – Wells Fargo was tops on our list as an alternative to Chase. We ended up not needing to go that route once CapitolOne360 started issuing check books, so we instead consolidated our personal checking there. But keep hearing great things about Wells Fargo.

I like credit unions, through shared branching I can access my CU accounts from all over the country. You can find a CU that does shared branching at this site http://co-opcreditunions.org/

The state department sent our passports to the RV park we were staying at. For a second account at a CU (that knew who I was) the mailing address was not enough, it was either the address on my drives license or a “utility bill” in my name.

We love Credit Unions as well. Unfortunately, the one I was member of when we hit the road wasn’t part of any larger network and we found that not overly nomad-friendly or high-tech. And joining any new financial institution is a bit of a hoop jumping, especially when you toss in needing to qualify for membership first too. If we were starting from scratch right now tho, we’d probably investigate more CU options now that technology has been catching up to the bigger banks.

We are really happy with all the options available through Wells Fargo as well. Although there are several branches near our home, we do all of our banking online. I hadn’t thought of the increased need for checks while staying at campgrounds (they are almost a foreign item now), so I will make sure we have a adequate supply 🙂 Thanks again for this great resource!

We’ve heard great things about Wells Fargo working well for nomads as well.

You may want to check more carefully into what can be deducted. It was recently ruled that if you use your RV for ANY personal use during a day, such as watching TV or fixing a meal, that you cannot deduct any business expenses during that day.

Thanks for the heads up.. I searched around and found some information on this. It is quite recent indeed. Here’s a link for anyone interested: http://taxlitigationsurvey.com/tax-court-rejects-rv/

In the case profiled, the RV was not being claimed as a home office, as the RV was not a permanent dwelling. So that part has not, yet, been ruled on. But indeed, the ruling could make that a tougher case to argue should it ever come up.

I would like to say wow on this post for the amount of information that you have shared. You two are always so great and helpful to everyone. On credit unions you touched on the shared ATM’s that many use but many are also using what is called shared branching. With ours I can go into over 6800 branches across to US and do my normal teller services. They just require you to know your acct. # and have valid picture ID. We have used it on our travels and it works great for us. For anyone who wants to see more info it is at co-opsharedbranch.org. I hope that this also helps a little. Thanks again for all that you do, Rick

.

Thanks a bunch for sharing more information about the credit union network. It’s a great option for those who qualify for membership to a credit union that offers the services they want.

Great resource. One footnote — it looks like PayPal doesn’t offer mobile deposit any longer as of this summer. http://www.bankrate.com/financing/banking/paypal-drops-mobile-check-deposit/

Thanks for the update, I’ve removed them from the list of institutions with the feature.