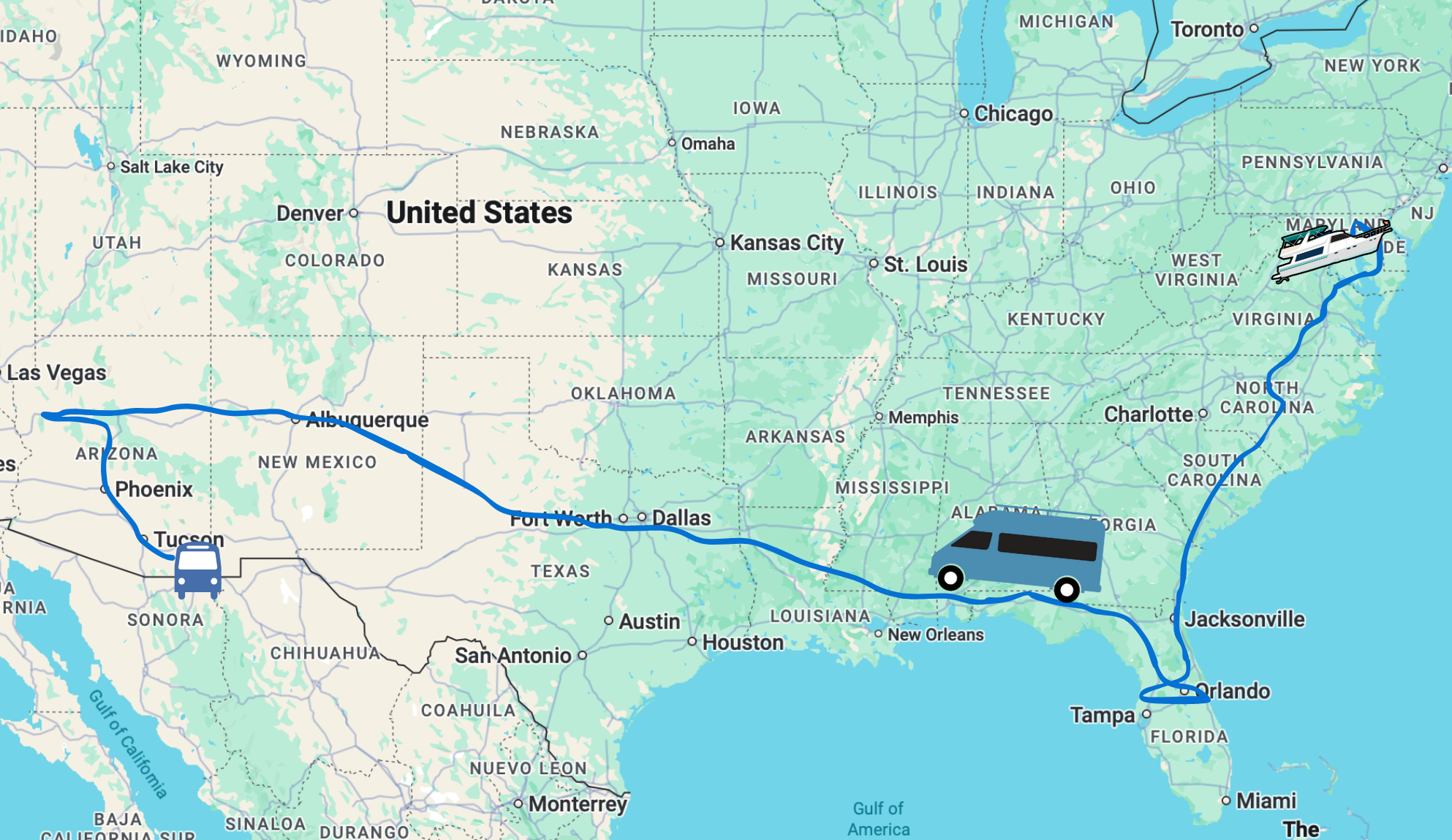

There’s a predominance of cloud based services that are tempting to embrace, particularly for us digital nomads looking to offload the burden of maintaining systems ourselves. Everything from back-up services, note taking, file sharing, document creation, e-mail, blogging and finances. A company offers a service, they provide the hardware, manpower and tools to host your data.

On a nice day, these are pretty fluffy white clouds – but clouds can turn stormy too.

On a nice day, these are pretty fluffy white clouds – but clouds can turn stormy too.

- Are back-ups and restore features provided?

- What about if the company has a failure that makes your data unavailable, or worst, they go out of business?

- Can you really trust the company to do no evil with your data?

For the most part, we’ve been very conscious of the cloud services we use – fully realizing and accepting their shortcomings, while appreciating the added dimension they add for us as mobile professionals. There’s a level of freedom and extra security in not having everything be local on a laptop or external drive that can easily be stolen or damaged in the course of our travels. But this must also be balanced with realizing the cloud isn’t always a replacement either.

For instance, we use Google Docs, but only for things that aren’t of critical importance where the benefits of sharing documents outweigh the risk. We still utilize a locally hosted office suite for documents created for clients. We use Evernote for storing receipts and information we gather, but carefully sync to two computers where the data is included in our back-up routines. We use Dropbox for file sharing and storage, and our DropBox is included in our normal back-up routines too.

And some things we just never trust to the cloud.

But I slid into the allure of a Minty Cloud

I was first introduced to Mint.com about 2 years ago at Macworld. Remembering how I appreciated its parent service from years ago called Yodlee – I signed up. At first, I used it as a quick and easy way to regularly overview my accounts to keep on top of unauthorized transactions, automatic deposits and the such.

As a new Mac convert, I was still maintaining my finances in Quicken under VMWare – and avidly researching finance organizing options that were Mac native (and the Mac version of Quicken at the time sucked).

Mint started rolling out more and more features that eventually made it easy to replace a lot of what I used Quicken for – mainly tracking my spending and preparing for taxes. It downloaded my transactions, allowed me to categorize them (even offering splits!), create budgets and add in manual transactions.

Along the way, I got incredibly lax about upkeeping Quicken and I put off looking for a Mac native replacement. After all, I got everything I needed right in Mint with minimal effort. I figured ‘one day’ I’d get around to having a local copy of my transactions again.

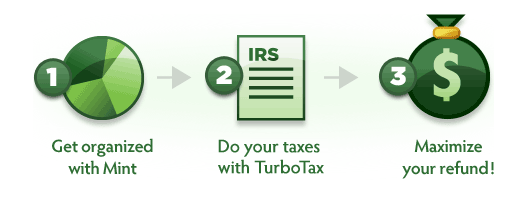

And when Intuit bought Mint, I figured this was just the way things were going anyway and I was ahead of the trend. I was even looking forward to their integration with TurboTax this year that they’ve been marketing.

For 2 years, everything worked great!

Until last night. I logged into Mint to deal with today’s transactions to discover that one of my accounts was showing up twice. I went into the account maintenance, found the duplicate – and proceeded to delete it out. No problem I thought.

Until I discovered that in the process, Mint deleted another completely separate account too!! And never asking me for confirmation.

Ok.. I thought. No problem. I just have to re-link the account, and everything should be restored – afterall Mint offers ‘bank-level data security’. And I’ve never had a bank loose my transaction data, because they do back-ups and stuff.

Boy was I wrong.

It took me all of a couple minutes to realize that not only had Mint added a duplicate account to my system, removed an account without my asking – they also removed 2 years of transaction history that I had meticulously categorized with no way to restore it (even if I had downloaded my history, like I should have).

And, when adding any new account into Mint, they are only capable of downloading a month’s worth of transactions. Meaning my only hope of ever restoring this account in Mint was limited to re-categorizing the past month, manually inputting anything else and going forward. (I’ll be saying ‘no’ to that proposition.)

Checking their support forums confirmed this is a known shortcoming of Mint that they continue to not have a solution for. Contacting customer support yielded no help either other than ‘we’re aware of the problems’.

Get this:

- They know that their software is generating duplicate accounts.

- They know that it is deleting wrong accounts.

- And they know that they offer no way to restore transaction history.

(Side note, I’m a software developer. If this was my product – I’d have immediately turned off the ‘Delete’ button until my team had a solution implemented!)

Did I mention that this account is our primary day-to-day spending account? Yeah. Huge data loss. Sure, I didn’t loose my actual account or any money – but I lost a lot of time.

Since I stupidly slowly allowed Mint to earn my trust – I have this data nowhere else. From this particular institution, I can download only 3 months of data – everything else is is only available in eStatement form. So I’ll be doing a lot of hand entry to restore at least 2010 for taxes.

And you can bet I won’t be doing that in Mint, or anything cloud like. I’ll be downloading the rest of account data from Mint immediately to use offline and locally – something I should have been doing all along. And if you use Mint, I suggest you do the same!

Lesson learned.

As appealing as moving things to the cloud is for a digital nomad, mind those lightening bolts!

Yea. they got me. i had mint to manage my three banks and one credit card. Every thing was fine until i canceled one bank account, mint erased every thing, told me it was their fault, but said there was nothing to be done, there was no backup or restore. Just reload your information. we are so sorry. yea.

You’ve confirmed my suspicions! I’m not ready to trust clouds yet – still doing everything on my laptop with daily backups to an external hard drive. Sorry for your pain, though! Cheers to the new year and no data loss (ha).

Wow sorry to hear this guys. I’ll make sure to mention if people ask me for more details on Mint. For me luckily I don’t use Mint for my books or tracking long term, more just as a really easy bird’s eye view for myself.

PNR Status

The moral of my story is, regardless of whether you live in the cloud or live locally, semi-regularly check that your backup process will really allow you to restore your data. When I first started with Quicken I did test the backup/restore process, but then never tested it again

I’ve used Mint for awhile but mostly as a side-deal that I can easily check in on not a replacement. All along I’ve had issues with accounts that won’t update for days on end (irritatingly asking me to enter my account info. over and over because it can’t connect). I’ve also got closed accounts – conveniently marked “closed” in the tool that it can’t connect anymore so it always tells me that I have accounts that can’t connect and need to be fixed – well duh, they’re closed! One of them, the bank doesn’t even exist anymore! LOL

Luckily at least so far I haven’t lost any data, but it’s been flaky enough that I have never been willing to rely on it.

I also used M$ Money for years and had to deal with their closing that line. Stinks! I’m a Mac person now, but I’m still using Window software for money management even now, with Quicken, which I loathe but it was the only easy move from M$ Money and the only thing I could find with all the features I wanted. Sigh!

After looking at MoneyWell, GnuCash and iBank – I just switched last week to Quicken Essentials for Mac (2011). So far, it’s meeting my needs. Unlike a lot of the negative reviews, I actually love that it’s not bloated with features I don’t need – and is essentially a local version of Mint that I can control the back-ups on. As I’m not dealing with debts and creating extensive budgets, it’s so far.. pretty on target. I’ll still be using Mint for a quick overview, and hoping that the progress is on to eventually sync Mint & QEM so I’m not maintaining two sets of data.

Excelent reasons to use open-source software with documented data formats. I use ikiwiki for my blog with a git backend — I edit the local version then use git push to publish to my remote vps server. The money example is why you not only need to have your own backups but they need to be in a published format that can be read by other programs.

Blars

http://techno-viking.com/

that is a complete nightmare to wake up and find all your data has gone missing and the worst part about it is that they know they are having a problem. am really sorry, like you i rely on online storage and backing up important data. i will change from now on and start even keeping hardcopies

Wow. That is unbelievable! That could sink a company – or it should! Like you said, turn OFF your delete option until you fix it Mint!

The migration to cloud computing has been a huge part of our client’s businesses in the last couple of years. And, honestly, backing data up has not been a big part of that conversation. I think people think of cloud computing AS the solution to the problem of having to back up local data.

I always thought they had a lot of redundant systems. If they aren’t in that business, what business are they in?

Wow. Really, this is a shocker to me.

Jennifer

Sometimes you can’t even trust your local financial data will remain secure.

My parent’s have more than a decade’s worth of financial data tracked with Microsoft Money. Only Microsoft has now discontinued the entire Money product line, with no upgrade path available.

Worse – Microsoft has announced that in a few months they will be turning off the Money activation server, meaning that even a fully legally bought copy of Money will be unable to be installed on any new computer. If your current machine / copy of Money ever breaks, you will be forever unable to even view your old data.

So so so lame.

Yes, that is complete BS. I noticed that happening with software that you had to “buy again” after a year with virus protections, for example. Drove me crazy. And with things like Money, they know that only a relative few still use the older versions so they seem to have no issue no longer supporting it.

I used to use Money, then switched to Quicken, but the biggest ease on my money management software issues came from making my systems easier, instead of tracking hundreds of categories.

Not making as much money helps a lot too, but I wouldn’t recommend it as a strategy 😀

In this case it isn’t just a matter of Microsoft dropping support for older versions of Money, but for the entire product line. My folks have the very latest version, and used to diligently upgrade every year. Now Microsoft is very literally screwing them over for all those years being a devoted customer.

At the very least, Microsoft should release a free patch that disables their DRM. Or release the last version of Money as a free (but unsupported) app.

Sorry to hear about that Cherie. Major bummer for sure.

I’ve been just as complacent about letting my Quicken SW lapse and just using Mint the past couple of years. Back then, my old reliable version of Quicken was going to expire and no longer allow electronic bank feeds to update it, while the new version they were wanting me to buy was getting lots of bad reports from users saying their upgrades messed up their data. I looked a little for a good local SW alternative, but didn’t find much out there, so I got lazy and just let Mint get all those transactions for me.

Well thanks for the wake up call! Time to go take another look at stand-alone SW options again.

Sigh.

I’ve been using Mint for a long time and haven’t had any issues yet. Of course I’m not a power user either.

Thanks for the heads up.

Bummer deal. I had a similar situation years ago with Quicken. I’d been faithfully keeping all my personal financial data in Quicken and dutifully using their backup option to create a backup file on a separate disk. So now the terrible day comes that my financial data has been lost (side note-never let teens have free access to “your” computer!) and when I try to restore the data from my backup disk, it says that the backup file is CORRUPTED! The dang program has been creating corrupted backup files and when I finally find an uncorrupted version, it’s two years old… sigh. My best cracking skills couldn’t retrieve the data, so a call to Quicken informs me that it would cost for hundreds of dollars for them to “attempt” a data retrieval. This became a crossroad for me and ultimately I decided that having that level of detail on my finances wasn’t really necessary and I changed how I track my finances all together.

The moral of my story is, regardless of whether you live in the cloud or live locally, semi-regularly check that your backup process will really allow you to restore your data. When I first started with Quicken I did test the backup/restore process, but then never tested it again so I wasn’t aware that somewhere along the line it stopped working. 🙁

After seeing a photo hosting website go out of business abruptly and have their servers taken over a couple years ago, I have in no way completely trusted all of something to any service. I always back up everywhere. And financial info is my biggest paranoia aside from digital images (memories & money).

I hadn’t jumped onto Mint for that reason, as well as I already having everything local and backed up remotely in Quicken anyway, and didn’t feel the need to switch.

This experience of yours certainly doesn’t help their cause.

That blows and I can relate to the need to have a decent solution on a Mac. I’ve done the same as you and come to depend upon Mint. I’ve noticed the duplicate accounts as well but luckily have not had the delete failure as of yet. One thing I have been doing that may help is when I have an account I don’t want to see I go into the “Hide” tab and just filter out those accounts.

Yeah.. the hiding/closing of accounts is useful – and I have used that in other cases. In this case, it deleted an account I hadn’t touched in the process. Which, in my opinion, is not an acceptable known bug to have lingering around.

ow ow OWWWW!!! Damn, that totally sucks! One more thing to put on my SpringPadIt task list…

I have been using Backupify to back up my Flickr, Google stuff, Facebook, Twitter, etc. But there is definitely a shift in what backup strategies one uses. Not too long ago everyone worked locally and worried about needing a remote backup. Now we work remotely and worry about having a local backup. Or, to be more precise, now we need to backup in two different directions.

And if dropbox went down, would it wipe out my local copy? Great, another thing to worry about!

Hah.. I love your point about how we once sought out remote back-ups, and now needing local. Great perspective!

I have our DropBoxes set up as part of our local backup process. So for us, stuff in our shared DropBox is the most secure of all – it is in the cloud, on both of our machines, and on both of our backup HD’s.

Also – DropBox saves revisions on the server, so we can even roll back time if we need to get an old version of a file.

I wish I could get an affordable equivalent of DropBox for all of our local storage.

Hey Chris,

Not quite as simple as DropBox, but any configuration management system should be able to do your revision-based backup. Try Subversion (SVN) or its newer competitors. Cherie, as a Software Developer, might now some of these programs.

Hope this helps, and I enjoy reading the blog,

-Shiri (also known as TMFShirKi from MDP)

Shiri –

Indeed, I am a huge fan of Git for version control. That is how I back up and manage all our source code, and I’ve even started to use it to manage revision control for the website.

I actually combine Git and DropBox using a simple tool called GitBox. This lets me use a DropBox as a master Git repository.

If only Mint had a user-accessible revision control system that we could roll back!

Don’t know how you feel about open source software, but GNUCash has an OSX version:

http://www.gnucash.org/

Thanks.. we have looked briefly at GnuCash, and they certainly will be evaluated as our potential local solution.

I have wondered, too, about these Cloud Computing options for exactly the reasons you state. How secure are they…and I don’t just mean to people taking my data but how stable is that ‘cloud’ up there? I prefer to have all my data in my control…as onerous as that can be sometimes!

There are certainly advantages to some cloud based services – the error is in assuming they are a safe replacement for however you’re handling things now/before. I think it’s best in most cases to view cloud services as an additional tool, not a solution in and of its self.

When the cloud fails, it has the potential to fail dramatically.

I am reminded of social bookmarking site Magnolia.com. Thousands of users trusted Magnolia to keep their bookmarks safe, until the day that the servers crashed… And only then did Magnolia discover that their “industrial grade” backup systems were corrupt, and most user data was lost forever.

*ugh*

I’ve even had GMail lose emails on me before. And with most cloud’ish Web 2.0 services, there are no humans easily reachable to try and get help from.