<— Read Chapter 9: Picking a Domicile State, Getting Mail & VotingRead Chapter 12: Approaching the Overwhelm of Preparing for Full Time Travel —>

Just a note – throughout the article below we link to several financial institutions that claim to offer the features we talk about. We have not tried them all, and do not necessarily endorse any particular account. We provide the links to give you a place to start your own research. Feel free to leave comments on this article about what works for you, so that others might benefit from your experience.

Banking – Checking & Savings

Since we first started this series, handling money on the road has become much easier. There are more and more options available for comprehensive online banking, allowing many nomads to wander without worrying about how they’ll access their funds. However, there are still many things to consider to make sure you have everything setup to handle your traveling lifestyle.

Your options range from nationwide & international commercial banks with a physical presence, online only banks, credit unions or living totally off cash & refillable credit cards.

Some of the key features you might want to look for include:

Easy Transfers to Outside Accounts

If you settle on multiple banks to meet your financial needs – which we think is a pretty good idea – then you’ll want to make sure your institutions give you easy ways to transfer funds between them. Some call this ‘External Accounts’ or ‘Linked Accounts’. Be sure to investigate how many they allow to be attached to your account, and if there are any fees involved for transfers. In general, you can initiate a transfer of funds that show up in your other account within 2-3 business days.

We do strongly recommend keeping accounts at multiple unrelated financial institutions, especially while traveling. So many things can happen while out on the road that might cut off your ability to get at any given account – ranging from having your account login info compromised to your bank suddenly going out of business.

While ultimately things will probably end up sorted out without any actual financial losses, the mess of logistics required to regain access might leave you in financial limbo for days or even weeks. Having a secondary account ready and setup can prove to be a trip saver!

Online Access

Most banking options these days have an online component. Some are really quite robust, and some really quite lacking. When selecting a bank, see if a demo of the online interface is available to make sure it gives you everything you think you’ll need to manage your finances online. Unlike living down the road from your financial institution’s branch, you won’t be able to just walk in to take care of transactions. If you can’t get a demo and still do open an account on faith, don’t hesitate to close your account if you’re not happy and try again elsewhere. A crummy online experience isn’t worth living with.

Another tip – spend a good bit of time navigating the institution’s website from what your typical internet connection on the road might be. If it’s particularly slow to load, it may be frustrating to use while on the road. As much as we prefer to support smaller banks and credit unions, some have awfully slow and bloated sites, and many don’t have the funding to put as much infrastructure into their online services.

We also favor banks that make setting up & closing accounts easy online, instead of needing to handle paperwork in person or via the mail.

Smartphone Access

A sign of a forward thinking financial institution is having their own mobile app for iPhone and/or Android. Many banks are rolling them out, giving you safe access to your accounts even while you’re away from your computer. Some allow you to transfer funds, pay bills, check transactions, pay others, find their ATMs or even remotely deposit checks.

Those that offer it tend to proudly display this on their websites, so it should be fairly easy to check this one off the list if it’s important to you.

But try the app first, and check the reviews! There is a lot of extremely underwhelming apps out there!

Depositing Checks

While you think that going nomadic might mean a paperless existence, we’re constantly surprised with how often we receive those funny paper checks. Investigate how the institution expects you to deposit checks into your account while you’re out roaming.

Can you deposit via an ATM? Only at a branch? Must you mail the check in? Can you scan the check and upload it online?

Or even better, does their mobile app allow you to snap a phone camera picture of the check and deposit it from anywhere?

Chase, Bank of America, USAA, ING Direct, PayPal, Charles Schwab, State Farm, Everbank, US Bank and some credit unions are amongst the ones currently offering mobile apps with check deposit built in. And more seem to be popping up regularly. Be sure to check:

- The conditions under which the feature is offered – such as eligibility and account minimums. For instance USAA requires you be eligible for full membership, including having a loan or insurance with them.

- What the per transaction limit is, which may not be immediately disclosed upfront. It can be most frustrating to receive a check for $1100 and then find out the mobile deposit limit is $1000 – causing you quite a delay in having access to your payment.

We find this to be an important feature not just for handling paper checks, but also for more quickly managing external account transfers. Electronic transfers can take 2-3 days, while a check deposited by SmartPhone may take less than 24 hours to become available. So if we need to quickly move funds around, we’ll sometimes just write ourselves a check instead.

Another option is having checks sent to someone you trust to handle deposits locally for you. We do this particularly with our business payments when clients insist on paying by check instead of electronically (grrrr). If we had them sent to our mailing address, it would add a few weeks before they caught up to handle ourselves. So instead, we have certain clients mail payments to my office manager (aka Mom) and she handles the deposit for us.

ATM & Cash Access

You’ll be roaming around and probably need some cash from time to time. But more than likely, you won’t always have easy access to one of your financial institution’s own ATMs. This can translate to extra fees to get cash at other bank’s machines.

Some banks are aware of this and will actually reimburse you for any ATM fees regardless of which ones you use – Ally, USAA and Everbank are amongst those that do. Charles Schwab actually reimburses for ATM use around the world – a great benefit for international nomads. Others are aligned with extensive ATM networks that make them quite accessible. ING for example uses the AllPoint network, which has ATMs that can often be found in many retail locations such as Walgreens, Target, CVS and 7-11.

For credit unions in particular, many of them are part of an alliance that gives you access to your account for cash and deposits at any credit union ATM that is part of the network. So if you’re eligible join one, this might be a workable solution.

And of course, you can always get cash back on purchases at grocery stores if you use your debit card.

Paying People and Being Paid

So how will you get money out of your account and into the hands of those you owe? Of course there’s checks, which as RVing nomads we seem to write a lot of, such as to campgrounds with self pay stations.

But we love paying people electronically whenever possible and consider a peer-to-peer payment option an essential bank feature. On Chase it’s called ‘QuickPay’, on ING it’s ‘P2P’ and Ally Bank calls theirs ‘Popmoney’.

These are built in payment options that allow you to directly transfer funds to another person’s account regardless of what institution they’re with. Some require you to have their account info, and some just their e-mail address. And some with mobile apps allow you to reimburse folks in person. These are ideal options for transferring funds with folks you trust – friends and family. We also regularly use this service on our small business account to pay our sub-contractors. Often these services do not have any transaction charges, which is why we prefer them. They also work in reverse, allowing you to receive money from others.

There’s also options of using an external service like PayPal, Dwolla or Venmo – where you externally transfer funds into their service, and then designate payments to others. And, you can also generally use your credit card for payment – giving you a double layer of security. These are safer options particularly for dealing with merchants or individuals you may not directly know, but also may have fees involved with them. And sometimes this may be the only feasible and quick option for dealing with international transactions. These services also allow you to accept payments from others, making them ideal to use when selling stuff.

For instance, we use PayPal to accept contributions for the ‘Pay as you wish’ eBook version of this blog series, and for selling stuff on eBay.

(If you’re enjoying this series, we welcome your ‘thank you’ bucks!)

And it’s never been easier to accept credit card payments than now – as with services like Square, you can easily set up a no monthly fee merchant account and accept payments right on your smart phone. Perfect for mobile vending.

Before you set off on the road, you might want to think about how’ll handle a large transaction, and how quickly you can get access to your liquid assets. We’re constantly surprised by how often this has come up in our travels – from needing to buy vehicles & RVs, putting down a deposit on a rental with a remote landlord or perhaps a major repair bill. Sometimes, a merchant just won’t accept a non-local personal check and we’re left needing to come up with cash, certified check or wiring funds. If your bank isn’t nearby, or it’s after banking hours, this can be problematic.

Here’s some of the situations we’ve encountered:

-

Our St. John Island Jeep – paid for by an ING P2P electronic transfer. We arrived to the Virgin Islands in 2010 and needed by buy an island Jeep from a private individual. He didn’t trust that once he got the payment notification from ING that the money was withdrawn from our account and would arrive in his. We ended up having to wait a couple extra days to get our Jeep until he saw the money in his account. (Before we left the island, we just sold the Jeep for cash. It was far cheaper to buy/sell a vehicle than renting for 5 months.)

- When we needed to unexpectedly trade in our tow vehicle for a newer truck to tow our Oliver – our funds were mostly in ING, who at the time didn’t issue checkbooks. And nor do they have instant wires. There wasn’t enough time to get the funds transferred to our Chase account, so we ended up taking out a loan so we could drive the truck off the lot that day (and then paying the balance off).

- When we started hunting for our bus we thought ahead and put a sizeable amount into our Chase account to give us more flexibility. Our eventual seller however wanted cash only, no discussion. Thankfully Chase had branches in Arizona. Unfortunately, the closest branch didn’t have $8k in their drawers (seriously?!?!), so they sent us scurrying across town to a branch with more cash on hand.

Fees and Rates

And of course, we want all the features, while paying no fees… oh, and throw in some interest on our deposits too! If you’ve not checked it out yet, Google has an account comparison tool that allows you to quickly check out the current offerings of many banks and find the best for your situation. Just be sure to fully research the features of the bank beyond their fee structures to make sure you’re getting a solution that works for you.

Also, don’t choose on current fees alone. We’ve definitely been put in the situation of setting up our accounts and then a year or two later having the terms fundamentally change. Trying to re-arrange all your accounts can be frustrating sometimes leaving you feeling trapped and betrayed by your “free life time (or until we change our mind) checking” bank. Chasing the absolute best fee & rate structures sometimes is just not a worthwhile endeavor – better to focus on quality, stability, features, and service.

Some Other Nomadic Banking considerations –

While banking as a nomad keeps getting easier, there are some things to keep aware of:

- The Patriot Act specifies that financial institutions have a residential address on file for all of their customers. If you’re using a mail forwarding service address, you may find yourself being asked to also add a physical address to your file. Be prepared with one that makes sense for you.

- Some institutions are more nomad-aware than others. For instance USAA is a credit union for military families and is used to dealing with folks who move around a lot. And Alliant Credit Union has an affiliation with the Escapees RV Club and is quite mobile friendly, and apparently one of the few financial institutions that will finance RVs for full timers without a physical garaged address.

- Many credit unions are part of a network that allows each branch to be linked together as if they were one institution. This gives you access to in person banking needs at over 5000 locations across the country. Check to see if you qualify for any of the participating members.

- If you’re intending some international travels, be sure to select a bank that has you covered around the world. HSBC is a popular worldwide banking option as they have locations all over. Charles Schwab is popular for their worldwide ATM reimbursement, and USAA as they support military families around the world. There’s reports that primarily online banks like ING also work quite well internationally too. Some nomads have reported difficulty with using services like PayPal, referencing account lock outs when accessed from varying locations (we’ve encountered this a few times ourselves just using it across the US.)

Credit Cards

A lot of folks are very anti credit card, and with good reason. Without discipline, it can be easy to quickly get yourself into a heap of difficult to pay off debt. They have high fees that get worse the deeper into debt you go, and encourage you to pay minimum payments that will leave you in debt for many years.

A lot of folks are very anti credit card, and with good reason. Without discipline, it can be easy to quickly get yourself into a heap of difficult to pay off debt. They have high fees that get worse the deeper into debt you go, and encourage you to pay minimum payments that will leave you in debt for many years.

We are debt free and think credit card debt is an evil cycle. But we are not anti credit card when they are paid off in full monthly.

They can be utilized to your advantage, and we find them pretty darn useful – if not essential – for our full time travels. If you’ve had trouble in past racking up credit card debt, you may need to do some mental re-thinking of how you approach using one.

So many services you’ll need as a traveler are simply difficult without a credit card number or even a credit card. Booking flights, trains, hotels and more is just so much easier if you have a credit card to put it on. And shopping online and renting a car pretty much necessitates a credit card number.

Here are some of the advantages that credit cards have for a traveler:

- Travel Insurance – Many credit cards provide insurance for disruptions in travel and accidents that might occur, including medical evacuation. Some even provide rental car full coverage, meaning you can decline at the counter.

- Ease of payment – Us nomads are frequently doing business remotely, and need an easy way to pay for services, reservations and things.

- Extended Warranties – Many credit cards provide a vastly extended warranty on many items you purchase. So your new camera may now have a 2 year warranty, instead of the manufacturer’s 1 year. Some even have accident insurance, such as when that new camera somehow ends up in your cat’s water dish (not that we know anything about this).

- Concierge Services – Some brands, such as Visa Signature (issued by many different banks), provides a free concierge service. Just call them up to help you out in just about any situation – from finding a supplier of a vat of nacho cheese sauce for a party, or locating a dentist with an immediate opening to fix your infected wisdom tooth. As travelers we sometimes just don’t have the local connections to find services when we need them. They’ll do the research and calling around for you.

- Disposable Numbers – Some cards come with a feature to generate a one-time use account number for online shopping, which can significantly reduce your risk of your account be compromised.

-

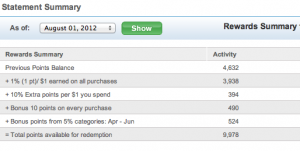

Our credit card rewards statement. Rewards – If you select a rewards credit card and you pay your balance off in full each month, you can actually make money off your purchases! We’ve selected a card that rewards cash back on our frequent sorts of purchases of fuel and groceries. But there’s all sorts out there, and some reward in airline miles or general points you can redeem for a variety of things. (One argument against credit cards is that we all pay increased costs as merchants pay a fee to accept them. If there’s ever a cash discount that exceeds our rewards percentage, we’ll take it instead.)

- Consumer Protections – This is probably our biggest reason for using a credit card whenever we can. If our card number gets compromised and unauthorized purchases are being made, we know fairly immediately (we download our transactions daily into Quicken Essentials – read here for why we no longer rely on Mint.com). All we have to do is log on to our account and report them – and they’re taken care of. We’re not responsible for a cent of it. Unlike if you use a debit card off your checking account, your entire cash balance could be gone before you even discover there’s a problem (we highly advise against using debit cards for this reason). Also, if we have a problem with a merchant not delivering as promised, we can refute the charge and let the credit card company handle it.

We do choose to carry multiple credit cards, as we’ve encountered a fair number of difficulties. Such as our credit card company locking our account down because we’re charging in a new location – despite this being ‘normal’ and us telling them multiple times that we travel full time. Also with filling our 140 gallon diesel tank at the pump, many pumps cut off after $75-125 and won’t let you re-run the same card more than a couple times. There’s ways around this of course – such as using truck lanes and/or paying inside.

Google also offers a credit card compare tool to shop for the best deals out there.

If you’re still not comfortable with using credit cards, there are other options of course. Some folks we’ve encountered load up refillable credit cards with cash, and then use those when they’re needed. And some folks somehow manage to survive by using just cash and checks.

Our current personal banking arsenal

First of all, we’re one of those couples who keeps separate personal finances, and then consciously merges our joint daily expenses. As we’re intentionally unmarried and our income sources were quite different when we met (him: primarily investments ; me: primarily earned), this makes filing our individual taxes easier as well as funding our retirement & health savings accounts. Fact of the matter is tho, most of our daily expenses are joint.

– ING’s iPhone app

– ING’s iPhone appFor our personal checking, we currently have individual personal accounts with ING Direct. We love them, and they keep adding features that make them ideal for nomadic life. They’re totally online, have easy payment options to others and transfers into our other accounts. Their new iPhone & Android apps allow deposit by phone, and they have a new ‘Bump’ feature where we can instantly transfer money to each other by tapping our phones together (fun!). And new to ING in the past few months, you can now have an actual checkbook! ING has no account fees and no minimums, and is interest bearing.

If you’re interested in trying out ING, drop us a line – we can send you a referral invitation that gets you a bonus $25 when you fund a new account.

We keep a joint checking account with Chase, which we originally opened up with WAMU who got gobbled up by Chase. We use this account for the occasional check we have to write – campground fees, bus maintenance, rally fees and such. We love the features of Chase – their online management, their iPhone app (they were one of the first with deposit by phone) and QuickPay. What we don’t like is that a while back they went from no fees and no minimum, to now charging $12/month or requiring a $1500 minimum balance. For our limited use of the account, we find this steep. This has us shopping around for other options – although we do like their fairly nationwide brick-n-mortar presence which has come in handy from time to time. We have tried Bank of America, and weren’t impressed. And we’d love to have a joint ING account as well, but they don’t allow more than one checking account per person – besides, we believe diversification is a good thing.

We just got our invitation to try out the Simple bank beta, which claims to be a revolutionary change in banking. We’re looking forward to seeing what that’s all about.

The majority of our daily expenses however gets charged to our joint Chase Rewards cards, which we each pay half of every month. It never carries a monthly balance, we never incur interest charges or fees and we earn about $30-40/month in cash rewards plus all the other consumer protections. We charge most everything we can to this card – fuel, groceries, dining out, household shopping, cell phone bills, campground fees, online shopping, etc. We keep a back-up joint credit card, and each also have an individual card.

We keep a small business checking account at Chase, which gives us all the same features of our personal account – just with higher fees and minimum balances (ugh). We’d consider changing to something else, if there were other brick-n-mortar options with the same feature set we enjoy at Chase nearby my folks, who handle depositing checks for us. So for now, we’re happy with our business setup.

Getting your Finances in Order

There’s a common assumption that you have to be absolutely debt free and have a ton of savings to hit the road. And we’ve heard the excuse over and over again – “I’ve got too many debts and no savings.”

Debt

For sure, being debt free is its own source of freedom and gives you tremendous agility and choice. Many folks who choose a nomadic lifestyle have also worked to earn their debt free status and built savings (us included) – but we consider these separate lifestyle issues.

The fact of the matter is, living on the road – cost wise – really is financially similar to any other lifestyle choice. You have living expenses, period. And you need a way to pay for them.

When you travel full time, those costs generally take the place of what you might have previously paid for your housing costs (assuming you cut those) – and sometimes they can even be cheaper and give you more flexibility to ride the feast and famine of income sources. There’s no set amount it costs to travel full time – it all depends on your style and preferences. While some budget travelers blog about living on $1200/month, it could easily cost a luxury traveler $10,000/month for their style. We openly share our monthly costs, but it’s only one data point and does not in anyway indicate what it might cost you.

Unless you’re retiring, taking a gap period (ie. being more on extended vacation than becoming a working nomad), just inherited a trust fund or are going on a very ultra-minimalist mission – you’re probably going to be setting up some sort of mobile income source. We covered over 60 ideas for this in Chapter 1 of this series. You just need to be sure that your mobile income source will cover the lifestyle you want, including any debt repayments you’ve racked up.

If travel is calling you strongly and you can otherwise figure out the rest of the logistics, we see no reason to put your dreams off until that elusive day that you’re debt free. A lot can happen in that time period, and who knows what other blocks might come up for you – health issues, family issues and more.

You can live mobilily, earn an income and continue to pay your debts down. Just like you can now living in one place.

But please note – we don’t encourage creating new debt, or shirking your responsibilities. And we strongly advise living well within your means, no matter your mobility status. And we do encourage striving for paying off your debts, it is a wonderful feeling to not have them hanging over you.

Savings

As far as having a massive savings account – sure, that makes navigating life’s many hiccups easier in any lifestyle. There’s a lot of freedom in knowing that you can handle any reasonable financial obstacle that comes your way by tossing some cash at it, and that you don’t have to take just any gig because you can live off savings for years.

But that doesn’t mean that to be nomadic you need to have lots of savings. Unless of course, you don’t want to earn an income anymore and will be living off your savings.

But if you’re living your life now without much of a cushion, it’s really not all that different living on the road. Unexpected expenses come up. Appliances break, pets get sick, transmissions need rebuilding, emergency trips ‘back home’ come up and sometimes you just need a pampering day at the spa.

How do you handle these things now? Sometimes you get creative in finding other solutions (bartering, fixing it yourself, etc.), you put things off until you can save up enough, you might put the expense on a credit card, you rob a convenience store (joking!) or you just work harder to bring in the funding you need. The same would be true on the road.

How much savings should you have to hit the road? Well, that will vary by your own comfort zone and expected lifestyle. We know folks who set off with none, and some with millions. Most of us are somewhere in between. If you’re also embarking on self employment after years of a steady paycheck, we do recommend having enough savings to survive a few months – learning the navigate the waves of feast and famine as an entrepreneur takes time.

Just like in any living situation – you can continue saving as you roam. Just spend less than you earn, and sock the rest away. (It really is that simple.)

Tax Considerations

When I was growing up, I remember being told there were two certainties in life – death and taxes.

Taxes is a very complex topic even without tossing in nomadism, and there’s no way we could cover all scenarios here. So let’s start this off by saying that you should definitely consult a nomad-aware tax professional for any specific advice you might need. Do plenty of research to make sure you’re handling things as best you can. We’ll only be talking in generalities here and pointing out some things you should keep in mind.

We’ve already gone over selecting a state of domicile, which includes state level tax considerations.

However American citizens will still need to navigate federal taxes. To the government, there is a difference between your state of domicile and your residence (where you live). You’ll use your domicile address on your personal taxes, and we find filing online to be the easiest way to handle this. If you’ll be traveling and earning an income internationally, research some of the tax considerations with this situation – you may be exempt from paying federal taxes if you’re outside the country for a certain amount of time.

For us domestic nomads, the federal government actually does recognize us nomads as transient tax payers and considers our residence to be where we’re currently living (not your domicile address). A common thing people assume – ‘Wow, you work on the road – that means you get to write everything off!’. Which is not true at all.. as technically you’re only allowed to write off travel expenses while traveling away from your home & business base.

Us nomads are in a tricky area, and there’s not been tons of precedent to give clear guidance.

The only time we write off our RV mileage and campground fees is if there’s a clear business purpose that we can document and justify – such as a client requesting our presence or we’re attending a business conference. While we could construct an argument that we need to perform quality assurance on our travel apps (Coverage? and State Lines) or that because we’re blogging about our adventures – we don’t even dare risk writing off all our travel costs. We probably lean more on the cautious side of the scale, and others may be far more willing to push the edges. Do your own research on this, and decide where your comfort level is.

A couple notes specifically about RVs for nomads.

- Yes, if it is your primary or secondary home, in most cases you can write off the interest on a loan that the RV is secured with.

- Yes, if your RV is your primary home – you can take solar energy credits when you install such a system.

- And yes, if you have a dedicated office area in your RV, you can write off a portion of the costs as a business expense – just like any home based business. However, keeping a dedicated office area in a RV is difficult in such a small space.

Here’s a great document about RVing and taxes by a long time RVer and tax professional that answers many questions about this subject much better than we can.

<— Read Chapter 9: Picking a Domicile State, Getting Mail & VotingRead Chapter 12: Approaching the Overwhelm of Preparing for Full Time Travel —>

No Excuses: Go Nomadic

This article is part of an ongoing series answering the common excuses folks give us for why they’re not pursing their dreams of full time travel. We launched this series a few years ago as Answers to the Common Excuses – and are in the process of massively updating it. We’ll be releasing newly updated & expanded chapters over the coming months. We’ll be addressing topics like: Affording It, Family, Pets, Logistics, Healthcare, Community, Keeping Connected and more.

Read the whole series: No Excuses: Go Nomadic

eBook version – This blog series is also available as a convenient eBook. We offer this compilation on a pay as you wish’ basis. We don’t aim to make a living off our blog, but contributions to keep the blog going is appreciated (kinda like taking us out for a thank-you beer or dinner).

Cost: Pay As You Wish (really… just set the price!)

PDF Format

Another method of transferring money between accounts is to maintain an online brokerage account like Ameritrade that acts as a go-between. You can transfer from one bank account into your online brokerage account and then transfer out to another account.

Indeed.. that could work if your banks themselves don’t support external account transfer. But it would add double the transfer time, as that’s two hops. (You could also do something like that through PayPal, if one one doesn’t have a brokerage account.)

If you have not already done so, I highly recommend that you consider adding mint.com to your mix. It is an online aggregator of accounts and provides a nice snapshot of all your accounts, credit cards, investments etc. as well as a budgeting tool, if one needs that option. And while one cannot perform any transactions on this site, it is a great way to track credit card charges etc. I have been successfully using it for a couple of years across a variety of platforms.

Mint.com is a pretty cool concept.. but as noted above, we ran into some pretty major problems with them that seriously messed up our data, and our trust in them.

I linked to it in the article, but here it is again:

https://www.technomadia.com/2010/12/the-minty-stormy-cloud/

As a result, we switched to Quicken Essentials, which is basically an offline version of Mint – but the data is kept more safely stored on our harddrive – where we can control the back-ups. And as a bonus, we can rely on it as a financial planning and tracking tool. Been very happy with it, and don’t miss Mint a bit.

Overall this is a pretty fabulous post. It’s given me a lot to consider. But I would like to point out one statement that isn’t exactly true, at least ways it’s not true for me.

“And of course shopping online pretty much necessitates a credit card.”

After going through bankruptcy several years ago I no longer have any credit cards. I could get one easily but choose not to at this point. I’m very leery of going there. But I do make frequent online purchases using my debit card! It has never been a problem. My partner does have one credit card that we consider an emergency back-up, but she also does her online shopping using her debit card only.

Well first of all, perhaps my statement should be ‘credit card number’ not necessarily a ‘credit card’. Which a debit card does provide.

However, I advise extreme caution with using a debit card for ANYTHING. I personally use them only in a last case scenario – I had to just last week when Chase locked our credit card because we were in a new location, and needed to check out.

Debit cards carry some pretty substantial risks with them. If the number gets compromised in any way, then your cash could be depleted before you even realize there’s a problem. With as many merchant websites who keep your number on file that get hacked, this is a real risk. And so isn’t giving your card to a waiter to go run your dinner charge – just takes one disgruntled employee to ruin your day. Or could be my own fault for leaving the card behind somewhere.

Yes, you can refute the debits – but it may be days or weeks before that money is recovered. Most banks don’t refund the money immediately, only AFTER the research has been done. Leaving you without access to funds during that time. And you may be liable for a percentage of the charges regardless.

With a credit card, you’re insulated from that. Notice suspicious activity, and you just refute the charge. In the case of our bank anyway, the charges are instantly taken off our account and then go into research.

Of course there are ways to better insulate yourself with a debit card, such as only keeping what you’ll need in the linked account. And then transferring in funds from another account as needed.

But for our needs, I don’t want to have to micromanage things like that.. and I definitely don’t recommend using debit cards. I used to work in a bank, and saw first hand the damage that can be done when a number is compromised.

Using a credit card and paying it off each month is totally possible – and a lot safer. You can manage it just as a cash account in your accounting program if you need to – set a spending budget, and deduct from it as you charge. You can even make more frequent payments so your cash account is depleting along side it.

You just have to mentally think of it differently than debt creation device that you got in trouble with before.

You do make a very valid point. And in so doing I would also be increasing my credit score at a faster rate than I’m currently doing, though it’s surprising how much better it already is!

I would for sure need to be using an accounting program which is something I don’t currently do. Pretty low tech here in that regard. I just keep a running tabulation on a piece of paper and check my balance online frequently. It’s true. I have an aversion to all things accounting. I hate thinking about numbers, money and math. So that’s just an inner resistance I need to get over and something I make out to be worse than it actually is I’m sure.

I very much appreciate your straight talk on the subject. I’m ALWAYS open to learning from others!

THANK YOU THANK YOU….on my list to do. So comprehensive…this is going to be so helpful!

You’re quite welcome.. I’m glad it’ll come in handy for you.